May 17, 2025, Post 1: India in the Eye of the Global Storm: A Quiet Roar of Growth | High Quality Mains Essay | Prelims MCQs

India in the Eye of the Global Storm: A Quiet Roar of Growth

Post Date : May 17, 2025

🎯 Thematic Focus:Economy | Global Trends | Public Investment | Resilient Growth

🕊️ Opening Whisper

While the world trembles in uncertainty, India does not sprint — it strides through the storm, steady and sovereign.

🔍 Key Highlights:

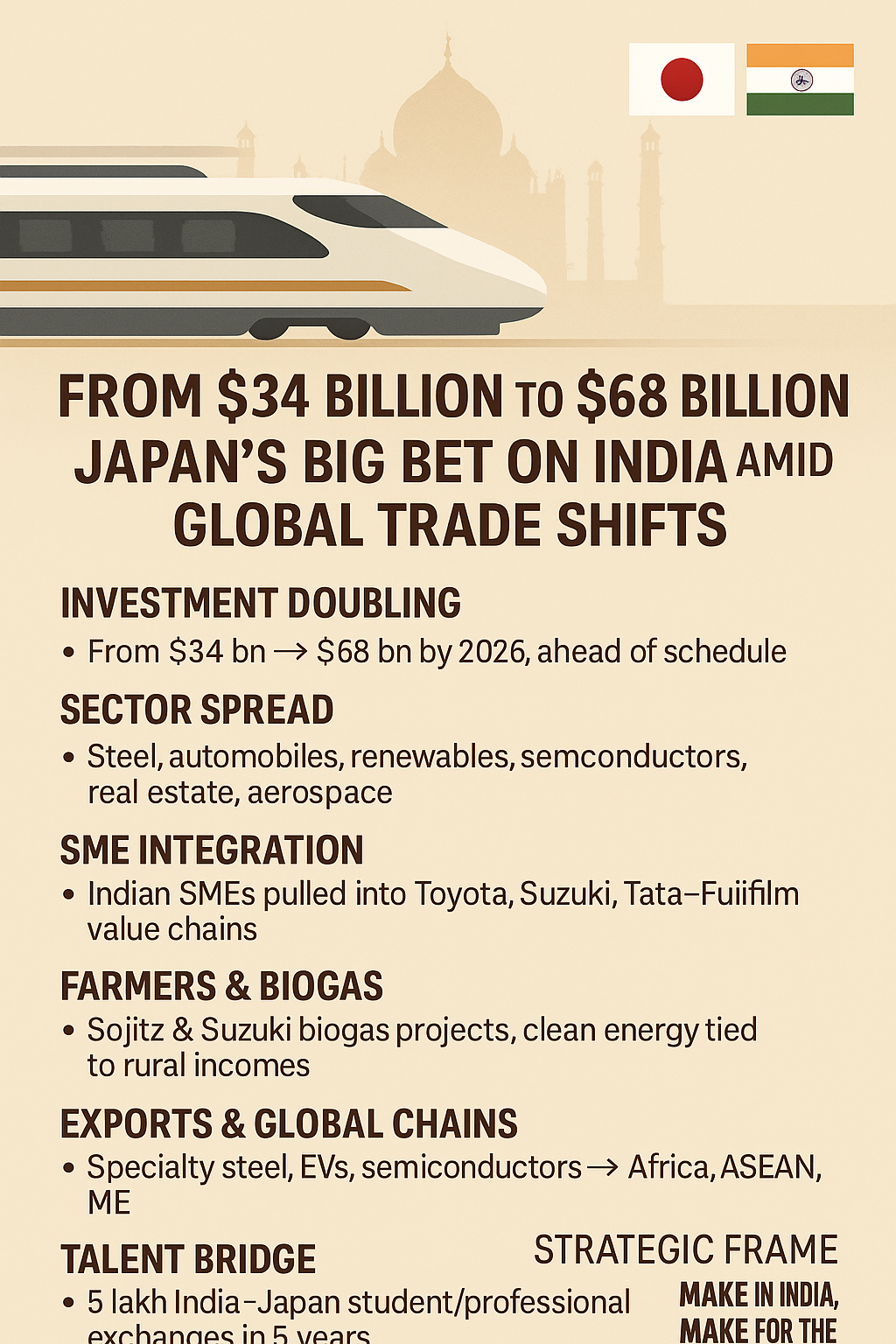

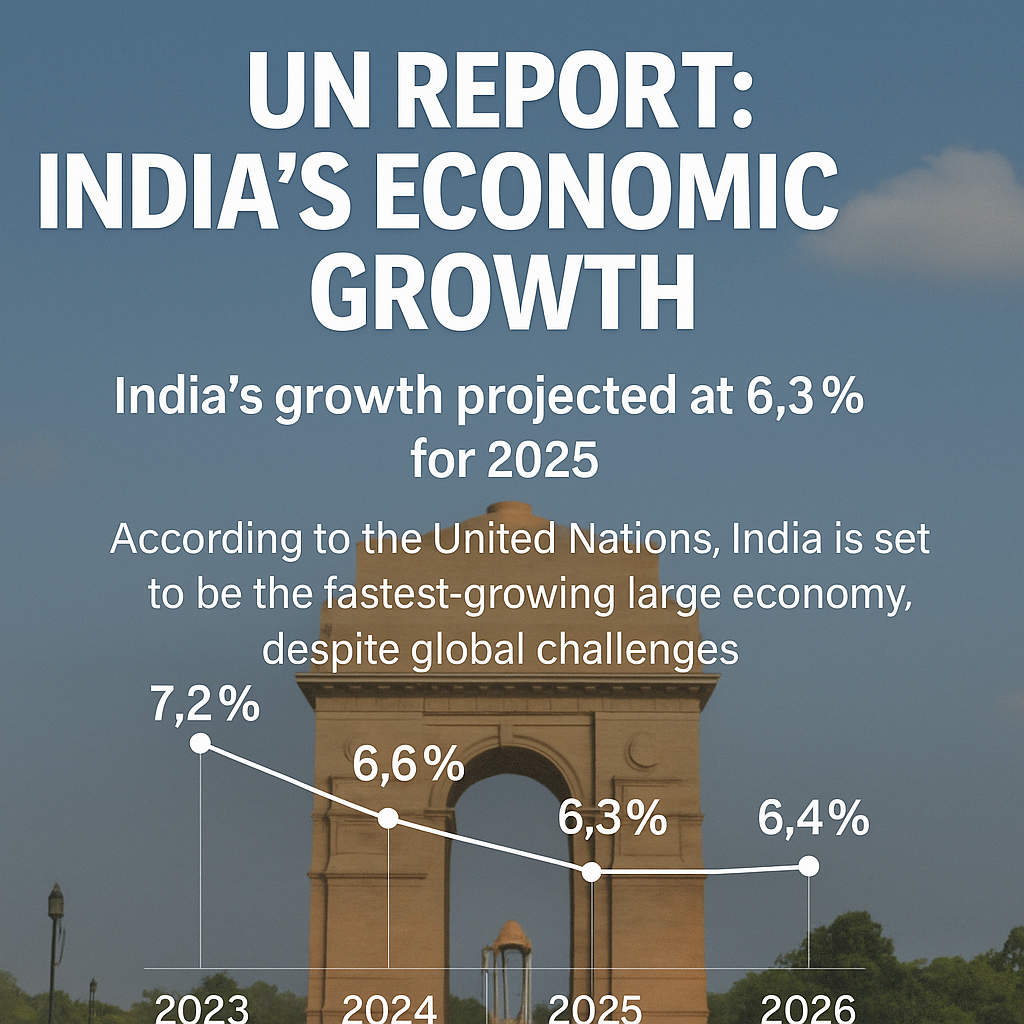

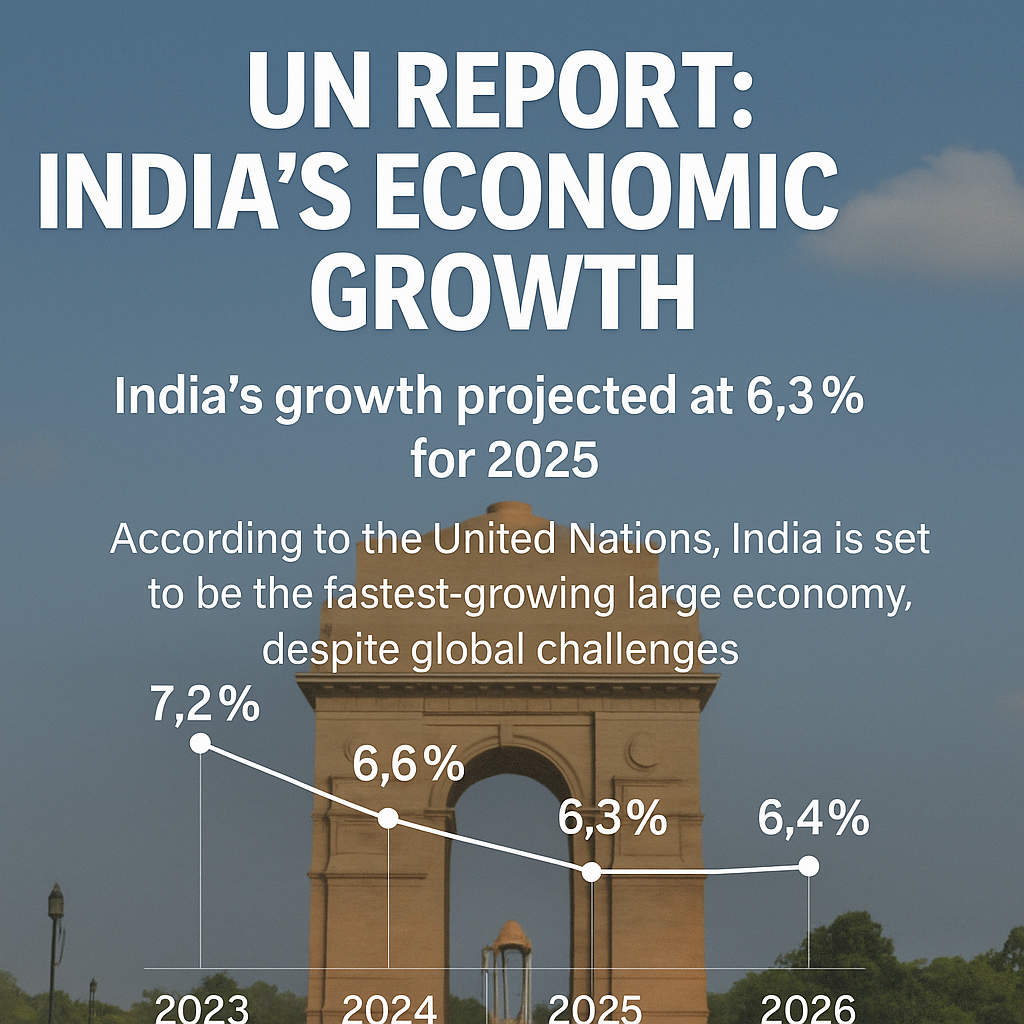

- According to the UN World Economic Situation and Prospects 2025 Update, India’s projected growth is 6.3%, the highest among large economies.

- 2026 projection is slightly better at 6.4%, underscoring long-term resilience.

- India’s performance comes amid a global slowdown — with global GDP expected to grow only 2.4%.

- Drivers of India’s growth include:

- Strong domestic consumption

- High government capital expenditure

- Employment stability

- Record exports and stock market highs

- Stock market boom: Retail investor base jumped from 4.9 crore (FY20) to 13.2 crore, with IPO capital nearly tripling.

- Exports at record USD 824.9 billion — led by services exports, followed by merchandise gains.

- Manufacturing sector remained steady in share of GDP and rose in Gross Value Added (GVA).

- Defence sector saw a transformation, with booming indigenous production and global exports.

- Inflation projected to fall to 4.3% — within RBI’s comfort zone.

- Employment is stable, though gender gaps remain.

📘 Concept Explainer: Why is India’s Growth Remarkable in 2025?

India’s ability to grow amid global uncertainty stems from:

- Large domestic market and consumer demand

- Public investment in infrastructure and defence

- Diverse export profile (services + manufacturing)

- Stable macroeconomic policy and inflation management

Compared to struggling developing and developed economies, India’s consistency and optimism reflect policy credibility and structural strength.

🗺️ GS Paper Mapping:

- GS Paper 3: Indian Economy – Growth, Inflation, Capital Markets

- GS Paper 2: Government Policy and Development

- GS Paper 3: External Sector – Trade, Defence Exports

✨ A Thought Spark — by IAS Monk

Growth is not always loud. Sometimes it is quiet, deliberate, and defiant — a silent roar that tells the world: “We will not collapse with the storm. We will rise with the rain.”

High Quality Mains Essay For Practice :

Word Limit 1000-1200

India’s Quiet Ascent: Navigating Growth in a Tumultuous Global Economy

Introduction

In a world fraught with economic uncertainties, geopolitical disruptions, and fragile market recoveries, India has emerged not just as a participant — but as a pillar of stability and optimism. The United Nations’ World Economic Situation and Prospects (WESP) 2025 Update projects India’s GDP growth at 6.3%, reaffirming its status as the fastest-growing major economy. This accomplishment is not incidental; it is the result of a robust combination of domestic consumption, targeted public investment, and a resilient external sector. India’s economic story in 2025 stands as a beacon — a demonstration of how policy coherence, market confidence, and structural reforms can together fuel momentum even when the world slows down.

Domestic Demand and Public Investment: The Twin Engines

A key reason for India’s resilience lies in the robustness of internal demand. Private consumption remains strong, bolstered by a growing middle class, digital penetration, and increased access to financial services and credit.

Simultaneously, government investment has played a transformative role. Massive capital outlays in infrastructure — from highways and railways to digital public infrastructure — have generated employment, stimulated private investment, and created a multiplier effect on the broader economy. The Centre’s emphasis on PM Gati Shakti, PLI schemes, and green industrialisation is beginning to yield tangible dividends.

Capital Markets: The Retail Revolution

India’s capital markets reached unprecedented heights in 2024–25, outpacing many emerging markets. The benchmark indices surged on the back of:

- Robust corporate earnings

- A broad-based IPO wave (with capital raised tripling YoY)

- Increased participation by domestic retail investors, which rose from 4.9 crore in FY20 to 13.2 crore by FY25

This financial inclusion of the masses into capital markets not only diversified household savings but reduced dependency on volatile foreign institutional flows, making markets more stable and democratic.

Export Landscape: A Twin-Sector Triumph

India achieved a record USD 824.9 billion in total exports in 2024–25. This was led by:

- Services exports, particularly in IT, fintech, education, and consultancy

- Merchandise exports, including pharmaceuticals, electronics, defence equipment, and textiles

India’s calibrated trade agreements, logistical upgrades, and improved ease of doing business have helped Indian producers reach non-traditional markets, deepening export resilience in the face of global demand shocks.

Manufacturing and Defence: Strategic Growth Areas

The manufacturing sector continues to contribute steadily to GDP, with notable gains in Gross Value Added (GVA). Importantly, sectors like electronics, automotive components, semiconductors, and green energy tech have grown due to strong demand and PLI incentives.

Meanwhile, the defence manufacturing sector witnessed transformational growth:

- Increased domestic production

- Significant growth in defence exports

- Strategic shift from imports to self-reliance

This aligns with India’s Atmanirbhar Bharat vision, and elevates India’s stature in the global defence supply chain.

Inflation and Employment: A Delicate Balance

Inflation is forecast to decline to 4.3% in 2025, within the RBI’s target band of 2–6%. This reflects:

- Effective monetary policy tightening in 2023–24

- Stabilisation in food and fuel prices

- Supply chain improvements and reduced volatility

Employment indicators show relative stability, particularly in urban construction and services. However, gender disparities persist, and the female labour force participation rate remains a concern. Inclusion, especially of women and informal workers, is necessary for India to sustain and democratize its growth.

A Fragile Global Context

The UN report also offers sobering insights about the world economy:

- Global GDP growth is expected at just 2.4%

- Rising trade tensions, especially between the US and China

- Supply chain disruptions, energy insecurity, and interest rate uncertainty continue to haunt recoveries in both developed and developing economies

In contrast, India’s trajectory provides stability amidst global fragmentation. It represents a counter-narrative — of trust-building, domestic resilience, and a long-term policy vision.

Conclusion

India’s projected 6.3% growth is more than just a statistical achievement — it is a civilisational statement. It affirms that in a world shaking under its own weight, India can anchor itself with policy, with people, and with purpose.

India’s challenge now lies not in proving its growth credentials, but in making that growth inclusive, green, and innovation-driven. With an eye on demographic dividends, climate imperatives, and global leadership, India’s quiet ascent may well be the defining story of the 21st century.

Target IAS-26: Daily MCQs :

📌 Prelims Practice MCQs

Topic:

MCQ 1 – Type 1: How many of the above statements are correct?

Consider the following statements regarding India’s economic performance in the UN’s 2025 outlook:

1)India’s GDP growth for 2025 is projected at 6.3%, the fastest among large economies.

2)India’s stock market underperformed compared to other emerging markets in 2024.

3)India’s exports touched a record USD 824.9 billion in 2024–25.

4)Inflation in 2025 is expected to remain above the RBI’s target band of 6%.

Which of the above statements are correct?

A) Only two

B) Only three

C) All four

D) Only one

🌀 Didn’t get it? Click here (▸) for the Correct Answer & Explanation

✅ Correct Answer: B) Only three

🧠 Explanation:

Correct Answer: B) Only three

1.✅ True – UN projected 6.3% growth, making India the fastest-growing large economy.

2.❌ False – India’s capital markets outperformed many emerging economies.

3.✅ True – Exports reached an all-time high of USD 824.9 billion.

4.✅ False – Inflation is projected to decline to 4.3%, within RBI’s target range (2–6%).

MCQ 2 – Type 2: Two-statement check

Consider the following two statements:

1)India’s growth in 2025 is largely supported by domestic consumption and government investment.

2)The UN has downgraded India’s growth to below the global average due to export challenges.

Which of the above statements is/are correct?

A) Only 1 is correct

B) Only 2 is correct

C) Both are correct

D) Neither is correct

🌀 Didn’t get it? Click here (▸) for the Correct Answer & Explanation

✅ Correct Answer: A) Only 1 is correct

🧠 Explanation:

Correct Answer: A) Only 1 is correct

1.✅ True – Domestic demand and public investment are major growth drivers.

2.❌ False – India’s growth is above the global average of 2.4%; not downgraded below it.

MCQ 3 – Type 3: Which of the following statements is/are correct?

Consider the following statements about India’s economic outlook for 2025:

1)Retail investor participation has tripled between FY20 and FY25.

2)The manufacturing sector’s share of GDP remained stable.

3)Defence exports have increased as part of India’s indigenous production push.

4)Employment levels have drastically fallen despite high growth.

Select the correct code:

A) 1, 2 and 3 only

B) 2 and 4 only

C) 1 and 4 only

D) 1, 2, 3 and 4

🌀 Didn’t get it? Click here (▸) for the Correct Answer & Explanation

✅ Correct Answer: A) 1, 2 and 3 only

🧠 Explanation:

Correct Answer: A) 1, 2 and 3 only

1.✅ True – Retail investor count grew from 4.9 crore to 13.2 crore.

2.✅ True – Manufacturing sector maintained its GDP share.

3.✅ True – Defence exports increased with indigenous production.

4.❌ False – Employment remained stable, though gender disparity persists.

MCQ 4 – Type 4: Direct factual

According to the UN WESP 2025 report, what is the projected GDP growth rate for India in 2026?

A) 6.1%

B) 6.2%

C) 6.3%

D) 6.4%

🌀 Didn’t get it? Click here (▸) for the Correct Answer & Explanation.

✅ Correct Answer: D) 6.4%

🧠 Explanation:

Correct Answer: D) 6.4%

1.✅ India’s GDP growth is projected to increase slightly to 6.4% in 2026, per the UN update.