001-Apr 5, RBI Holds Repo Rate at 6.5% – Understanding India’s Monetary Tools 📈

On April 5, 2025, the Reserve Bank of India (RBI) decided to hold the repo rate steady at 6.5% in its latest Monetary Policy Committee meeting.

This marks the fourth consecutive pause — signaling a cautious balancing act between inflation control and growth revival.

But what exactly is the repo rate?

And how do these decisions ripple through our economy?

Let’s break it down ⬇️

🧠 What is the Repo Rate?

Repo Rate (short for “Repurchase Rate”) is the interest rate at which the RBI lends short-term money to commercial banks.

When repo rates go up → borrowing becomes costlier → liquidity tightens → inflation is controlled.

When repo rates go down → borrowing becomes cheaper → liquidity improves → growth gets a boost.

🔁 What is the Reverse Repo Rate?

Reverse Repo Rate is the interest rate at which commercial banks deposit their surplus funds with the RBI.

It’s the flip side of repo.

The RBI uses it to absorb excess liquidity from the system.

🧮 What is CRR (Cash Reserve Ratio)?

CRR is the percentage of a bank’s total deposits that must be kept as reserve with the RBI, in cash.

It ensures banks don’t over-lend and remain liquid in emergencies.

CRR earns no interest for the banks.

📊 What is SLR (Statutory Liquidity Ratio)?

SLR is the percentage of deposits that banks must invest in safe government securities, before they can lend money to the public.

It acts as a safety cushion and controls credit expansion.

🧭 Why Should Aspirants Care?

- Repo, Reverse Repo, CRR, and SLR are key tools in monetary policy.

- They’re often used in GS3 (Economy), Prelims, and Interview answers.

- They reflect how central banks stabilize the economic heartbeat.

🔍 RBI’s April 2025 Stand

- 📍 Repo Rate: 6.5%

- 📍 Reverse Repo Rate: 3.35% (unchanged)

- 📍 CRR: 4.5%

- 📍 SLR: 18.0%

- Inflation projection: 4.9% for FY 2025–26

- GDP forecast: 6.8%

“The RBI remains committed to anchoring inflation while supporting a durable growth path.”

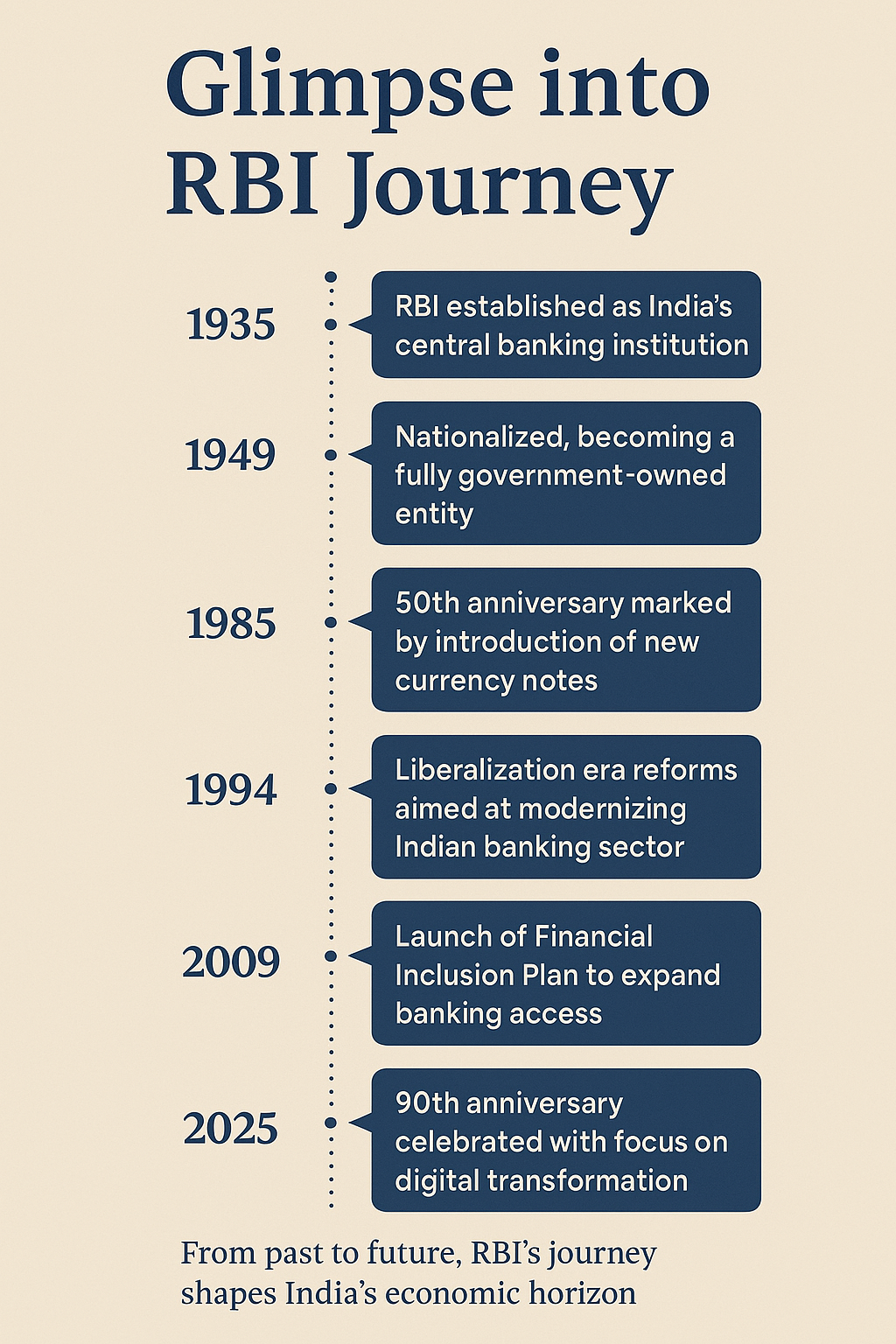

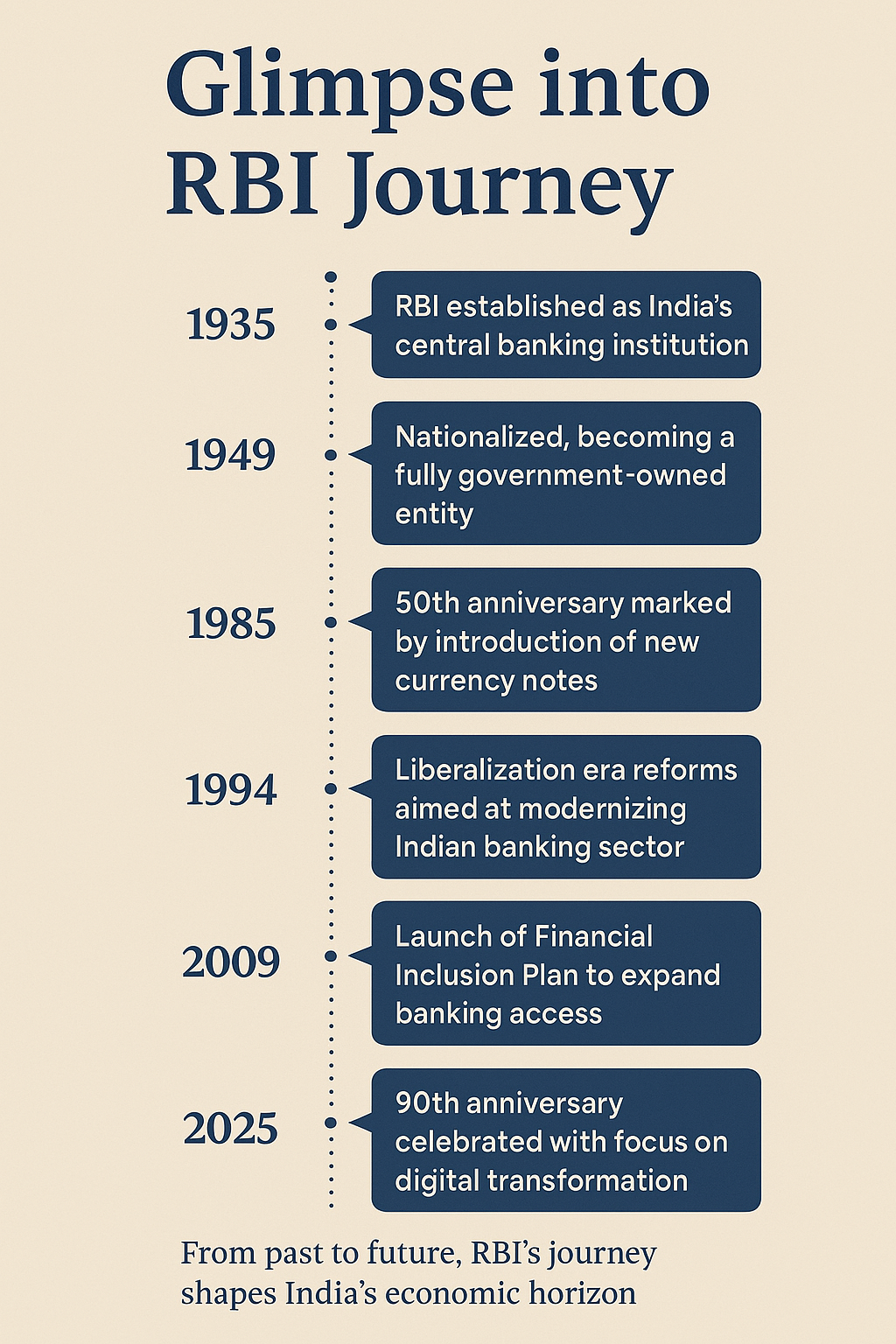

📊 🖼️ 📘 The Reserve Bank of India – A Brief Journey

- 🏛️ Established: April 1, 1935

- 📍 Initially headquartered: Kolkata → moved to Mumbai

- 🇬🇧 Started as a private institution under British rule

- Nationalized: January 1, 1949

- 💡 Key Functions:

- Issuer of currency

- Custodian of foreign exchange

- Controller of credit

- Banker to the government

| Year | Milestone |

|---|---|

| 1935 | RBI founded under RBI Act, 1934 |

| 1949 | Nationalization of RBI |

| 1991 | Major liberalization of banking sector |

| 2016 | Introduction of Monetary Policy Committee |

| 2020 | Digital innovations, UPI growth |

| 2025 | Fourth year of inflation-targeted stability post-pandemic |