072.

Economy & Agriculture

Retail Food Inflation Eases to 8.39%: Trends, Causes & Future Outlook

India’s retail food inflation dipped to 8.39% in December 2025, down from 9.04% in November and 10.87% in October, offering temporary relief to consumers. While this marks a positive turn, future trends remain heavily dependent on weather patterns, crop output, and global supply chains.

🌾 Agricultural Snapshot: Mixed Signals from Rabi Season

| Crop | Area Sown (2025) | Trend/Impact |

|---|---|---|

| Wheat | 320 lakh ha | Up from 315.63 lakh ha last year—good for supply |

| Chickpeas, Maize, Potatoes, Onions, Tomatoes | Increased | Driven by surplus monsoon, better groundwater |

| Mustard | Decreased | May push edible oil prices higher |

🌡️ Climate & Yield Concerns

- Delayed sowing and potential early summer may harm wheat yields.

- Ideal grain-filling temperature: Low 30s °C in March.

- High temperature risks could reduce grain quality and output.

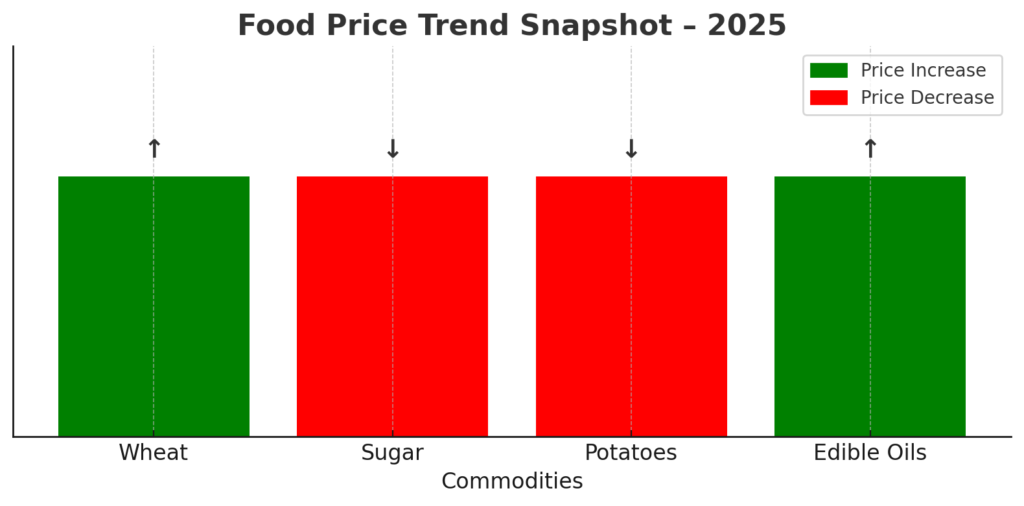

🧂 Food Price Trends

🧁 Wheat

- Stock: 184.11 lakh tonnes – 5th lowest since 2008

- Prices: ₹3,150–₹3,200/quintal in Delhi vs ₹2,550–₹2,600 last year

- Reason: Low open market sale by govt + harvest uncertainty

🍬 Sugar

- Production projected to fall to 270 lakh tonnes from 319 lakh tonnes

- States affected: Maharashtra, UP – drought & early flowering reduce sucrose

🥔 Potatoes

- Early heat → delayed planting

- Later improvements → larger tubers, better yield

- Prices falling, supply improving

🛢️ Edible Oils

| Oil Type | Price (per kg) |

|---|---|

| Palm Oil | ₹145 |

| Soyabean Oil | ₹155 |

| Mustard Oil | ₹165 |

- Reasons: Import duty, Indonesia’s palm policy, lower mustard sowing

⚠️ Key Drivers of Food Inflation

🔥 Weather Events

- Poor monsoon, heatwaves → crop damage

- Cereals & pulses inflation crossed 10% in April 2024

⛽ Fuel Costs

- 1% rise in fuel inflation → 0.13% rise in food inflation (over 12 months)

- Fuel drives transportation, irrigation, and machinery costs

🚛 Supply Chain Disruptions

- Affected vegetables most: 27.8% inflation for 6 months

- Cold storage, logistics gaps → spoilage and price spikes

🌍 Global Factors

- India imports 60% of pulses & edible oils

- Global-to-local price transmission is limited

- Russia-Ukraine war, palm oil changes affected supply

📊 Understanding Inflation Metrics

| Index | Measures |

|---|---|

| CPI | Retail price inflation (includes food) |

| CFPI | Specifically for food prices |

| WPI | Bulk pricing (used by producers) |

🧠 Inflation Types

- Demand-Pull: Too much demand, not enough supply

- Cost-Push: Rising input costs → higher final prices

- Wage-Price Spiral: Wages up → prices up → loop continues

🛠️ Government Measures

✅ Subsidies: Cheaper onions, tomatoes, wheat, sugar

✅ Export Bans: Wheat (May 2022), broken rice (Sep 2022)

✅ Stock Limits: Prevent hoarding

✅ Import Duty Cuts: Pulses and edible oils

✅ Operation Greens: Price stabilisation for Tomato, Onion, Potato

✅ MEP: $800/ton minimum export price for onions

🧩 Long-Term Strategies to Tame Inflation

- 💡 Improve Storage & Transport – Cold chains, rural logistics

- 🌱 Encourage Crop Diversification – Millets, pulses

- 🌾 Boost Productivity – Smart irrigation, seed R&D

- ⚙️ Leverage Tech – Tools like AmbiTag for spoilage control

- 📉 Monitor Prices – Regular data to set MRPs

- 🌧️ Climate-Adapted Agriculture – Rainwater harvesting, crop rotation