015 – Apr 8, 2025 💼

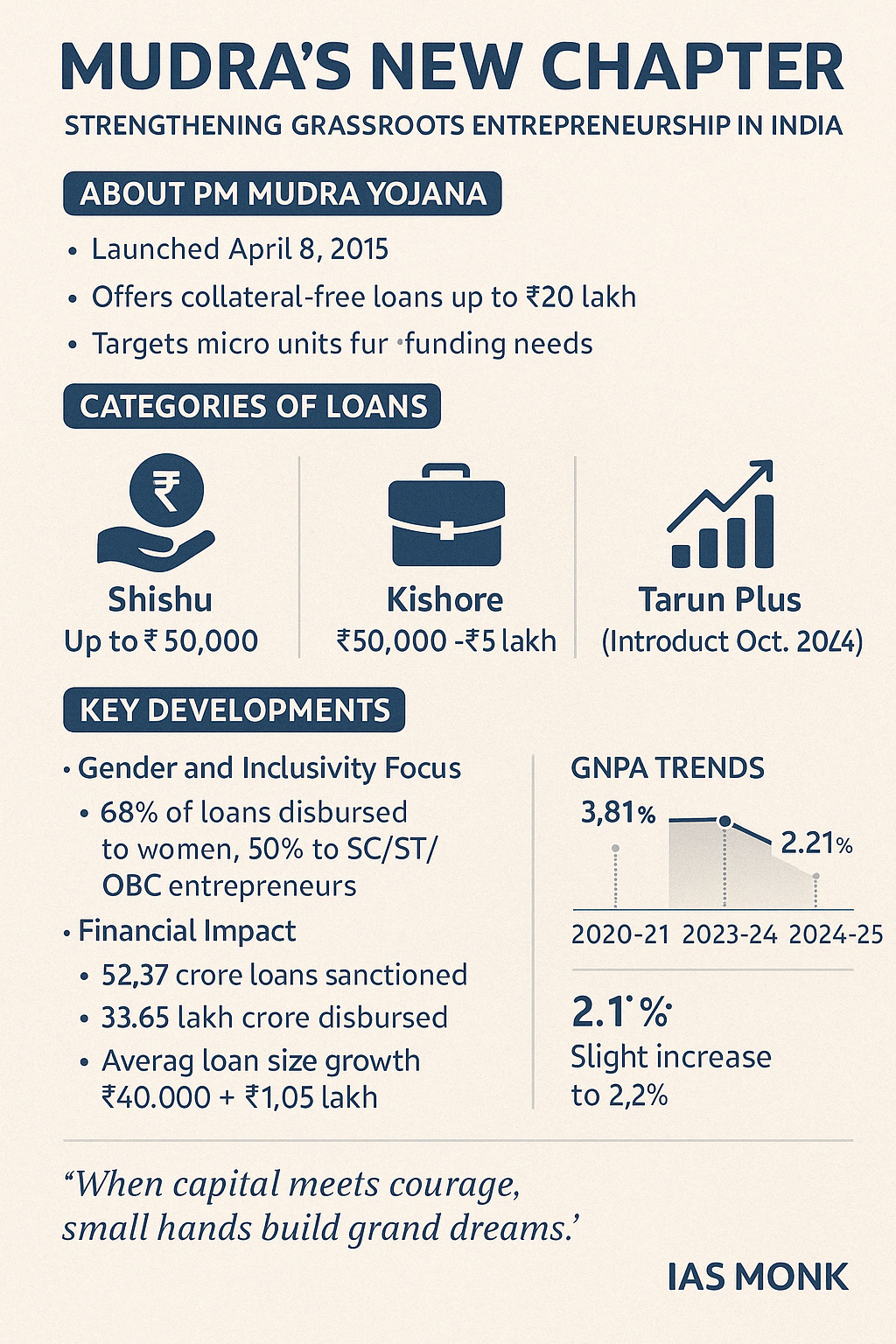

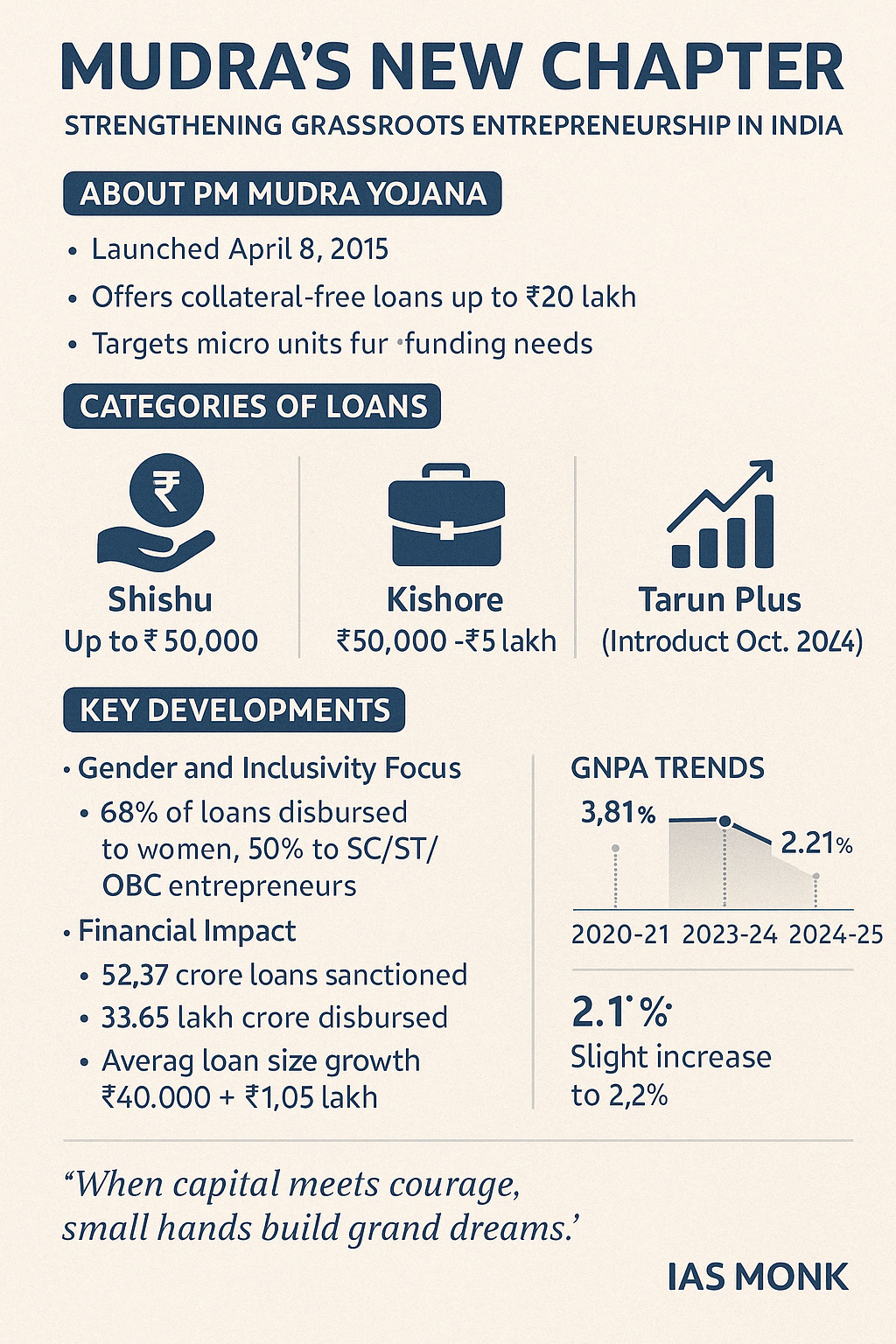

Mudra’s New Chapter: Strengthening Grassroots Entrepreneurship in India

🧭 Thematic Focus

Category: Economy | Financial Inclusion | Government Schemes

GS Paper: GS Paper III – Inclusive Growth | MSME Sector | Financial Institutions

Tagline: When capital meets courage, small hands build grand dreams.

🌱 Intro

As the Pradhan Mantri Mudra Yojana (PMMY) completes another year, it continues to act as a pillar of micro-entrepreneurship in India.

Despite a slight rise in Gross Non-Performing Assets (GNPA) to 2.21% in 2024–25, the scheme remains a beacon of inclusive financial empowerment.

🔍 Key Highlights

🏦 What Is PMMY?

- Launched: April 8, 2015

- Offers collateral-free loans up to ₹20 lakh

- Target audience: micro units, non-corporate small businesses

- Sectors: Manufacturing, Services, Trading

💰 Loan Categories

- Shishu: Up to ₹50,000 (early-stage)

- Kishore: ₹50,000 – ₹5 lakh (growth-phase)

- Tarun: ₹5 lakh – ₹10 lakh

- Tarun Plus (Oct 2024):

- For borrowers with good repayment history under Tarun

- Increased limit: up to ₹20 lakh

- Reached 25,000+ beneficiaries, ₹3,790 crore in disbursements

👩🌾 Gender & Social Inclusion

- 68% of loans to women entrepreneurs

- 50% allocated to SC/ST/OBC communities

- Reflects priority for marginalised, underrepresented groups

📈 Financial Performance

- Total loans sanctioned: 52.37 crore

- Total value: ₹33.65 lakh crore

- Avg loan size grew: ₹40,000 → ₹1.05 lakh

- GNPA:

- 2020–21 peak: 3.61%

- 2023–24: 2.1%

- 2024–25: 2.21% (slight rise, still manageable)

🎯 Future Targets

- Disbursement goal for 2025–26: ₹5–6 lakh crore

- Focus on Tarun Plus scaling, better targeting, NPA management

🏛️ Lending Ecosystem – Member Lending Institutions (MLIs)

Loans provided through:

- Scheduled Commercial Banks

- Regional Rural Banks (RRBs)

- Small Finance Banks

- NBFCs & MFIs

- Multichannel access ensures deep rural penetration

🧠 Concept Explainer: Why This Matters

PMMY is not merely a loan scheme—it is a trust signal to the informal economy.

Its success lies not just in funds disbursed but in dignity returned to the smallest dreamers.

A mild rise in GNPA must be met with financial literacy and ecosystem support, not rollback.

🗺️ GS Paper Mapping

- GS Paper III – Inclusive Growth, Financial Sector Reforms, Government Schemes

- GS Paper II – Social Justice | Women & SC/ST/OBC Welfare

- Essay Themes – “Small Loans, Big Hopes,” “Empowering India, One Shishu at a Time”

💭 A Thought Spark — by IAS Monk

“Not all wealth starts in vaults—

some begin in hands dusted with flour,

tools crusted with labour,

and hearts wired for flight.”