🧭Sep 1, 2025 Post 2: From $34 Billion to $68 Billion: Japan’s Big Bet on India Amid Global Trade Shifts | High Quality Mains Essay: | For IAS-2026 :Prelims MCQs

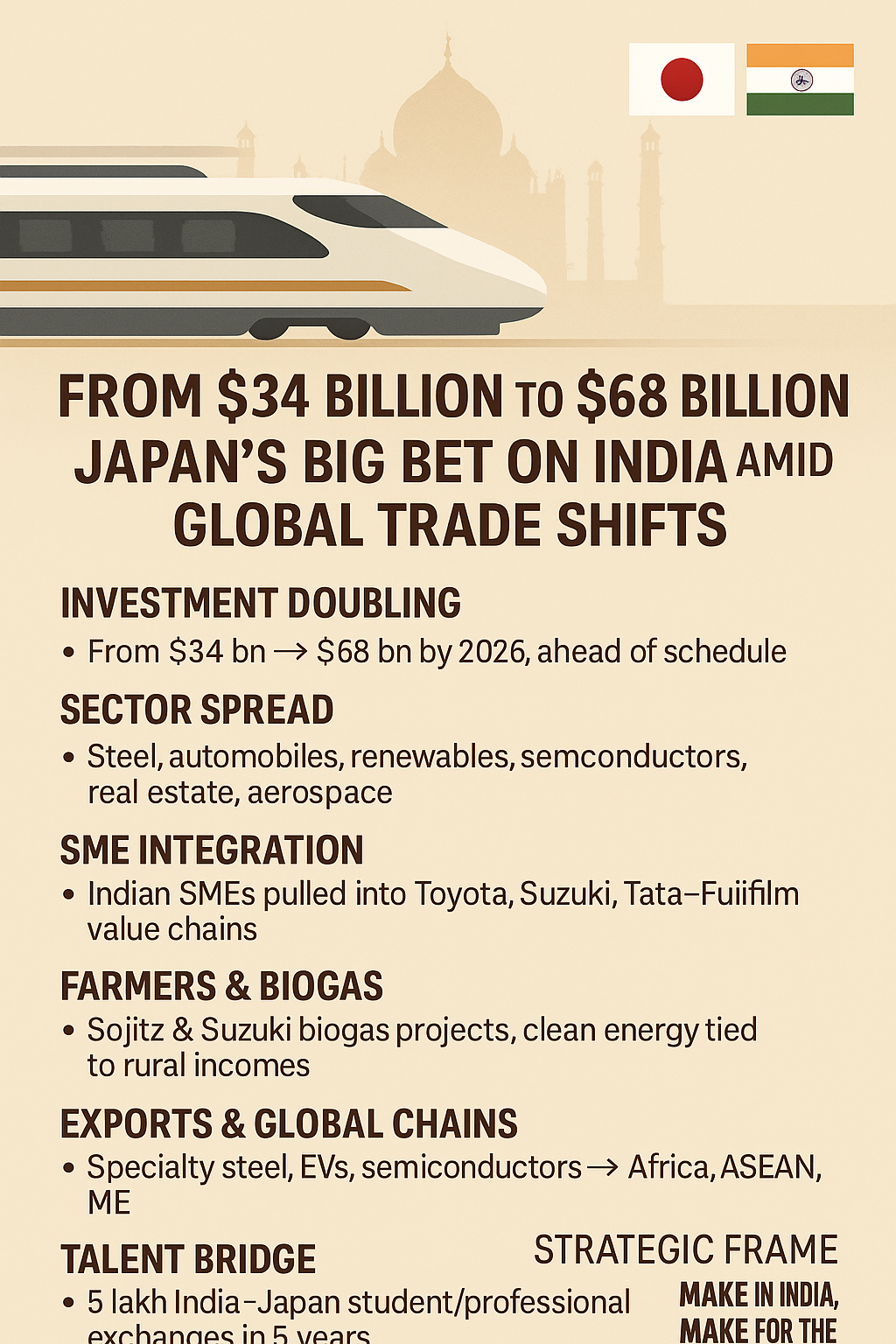

From $34 Billion to $68 Billion: Japan’s Big Bet on India Amid Global Trade Shifts

🌏 Thematic Focus

From $34 Billion to $68 Billion: Japan’s Big Bet on India Amid Global Trade Shifts

🌏 Thematic Focus

GS2 / International Relations & GS3 / Economy

🪷 Intro Whisper

When one partner calls it a “dead economy,” another doubles its faith. Japan’s doubling of its India investment target is not just capital — it’s confidence.

🌸 Key Highlights

- Investment Doubling: From $34 bn → $68 bn by 2026, ahead of schedule.

- Sector Spread: Steel, automobiles, renewables, semiconductors, real estate, aerospace.

- SME Integration: Indian SMEs pulled into Toyota, Suzuki, Tata–Fujifilm value chains.

- Farmers & Biogas: Sojitz & Suzuki biogas projects, clean energy tied to rural incomes.

- Exports & Global Chains: Specialty steel, EVs, semiconductors → Africa, ASEAN, ME.

- Talent Bridge: 5 lakh India–Japan student/professional exchanges in 5 years.

- Northeast Link: Assam–ASEAN Holdings MoU ties into Act East policy.

- Strategic Frame: “Make in India, Make for the World” now an Indo-Japan anchor.

📖 Concept Explainer

- Why Important Now: Comes amid US tariffs, Trump’s “dead economy” jibe.

- Geo-Economic Message: Japan signals faith in India’s growth → counterbalances US pressure & China rivalry.

- Multiplier Impact: Investments not just in factories, but in knowledge, skills, and green energy.

- Strategic Autonomy: India positions itself as a pole of stability → engaging both Japan & China while fending off US tariffs.

📊 GS Paper Mapping

- GS2: India–Japan Strategic & Global Partnership; Quad & Indo-Pacific.

- GS3: FDI, Infrastructure, SMEs, Clean Energy, Exports.

- Essay Links: “FDI & Strategic Autonomy,” “Make in India → Make for World.”

🌿 IAS Monk Whisper

Capital builds factories, but confidence builds futures. Japan’s faith is not in India’s numbers alone — it is in her people’s potential.

High Quality Mains Essay For Practice :

Word Limit 1000-1200

From $34 Billion to $68 Billion: Japan’s Big Bet on India Amid Global Trade Shifts

When history writes the story of partnerships that rose above turbulence, the India–Japan bond will stand as one of quiet endurance, steady faith, and patient construction. In an age when capital flees at the first sign of risk, Japan has doubled down — literally — on India. From a target of $34 billion in investments to $68 billion, achieved ahead of time, the message is loud: for Japan, India is not a gamble but a conviction.

This moment comes at a paradoxical juncture. Across the Pacific, the Trump administration has cast doubt on India’s economy, calling it a “dead economy” while imposing steep tariffs on Indian exports. Yet in Tokyo, the vision is the opposite — India is seen not as a weak link but as a growth partner, a pillar in Asia’s stability, and an indispensable partner for the 21st century.

I. The Doubling of Faith

The most visible headline is numerical: 5 trillion yen ($34 billion) already invested between 2022 and 2025, far ahead of the 2026 target. Now doubled to 10 trillion yen ($68 billion), this commitment signals acceleration at a time when global capital is cautious. Behind this lie more than 170 MoUs in two years, representing diverse commitments in steel, automotive, renewables, semiconductors, real estate, and aerospace.

Each investment speaks to a deeper confidence: Nippon Steel in Andhra Pradesh, Suzuki’s new mega plant in Gujarat, Toyota’s hybrid and EV lines in Karnataka and Maharashtra, Sumitomo’s multi-billion push into real estate, Osaka Gas expanding renewables with a green hydrogen roadmap, Astroscale joining ISRO for satellite launches. This is not just capital flow — it is a strategic endorsement.

II. SMEs: The Unsung Beneficiaries

Beyond the giants of steel and automobiles, Japanese investment has begun to reshape India’s small and medium enterprises. The Toyota–Suzuki supply chain is integrating hundreds of Tier-2 and Tier-3 Indian SMEs, pulling them into global production networks. Tata Electronics’ collaboration with Tokyo Electron and Fujifilm is laying the foundations of an Indian semiconductor ecosystem.

For SMEs, these ties are transformative: not only do they gain contracts, but also exposure to global standards, technology transfer, and entry into export markets. The ripple effects extend beyond revenue — they lift productivity, create skilled jobs, and upgrade India’s manufacturing competitiveness.

III. Farmers and Green Energy Futures

Perhaps the most quietly revolutionary aspect of Japanese cooperation is rural. Sojitz Corporation’s partnership with Indian Oil to establish 30 biogas plants will not only generate 1.6 million tonnes annually but also embed farmers in a clean-energy economy. Crop residues once burned or wasted will now fuel a circular system where rural households earn while the nation reduces emissions.

Suzuki’s cooperation with the National Dairy Development Board further ties the energy transition to the grassroots. By converting cattle waste into carbon-neutral fuel for CNG vehicles, Japanese technology merges with India’s dairy economy to create sustainable income streams. For rural India, this is industrial policy meeting village life — a story of modernity rooted in tradition.

IV. The Export–Manufacturing Link

The slogan “Make in India, Make for the World” finds a practical expression in Indo-Japanese ventures. Specialty steel projects will expand exports to global automobile and energy markets. Hybrid and electric vehicles made in India with Japanese know-how are destined for Africa, the Middle East, and Southeast Asia. Semiconductor collaborations with Fujifilm and Tata plug India into global chip supply chains.

What emerges is a triangular pattern: Japan’s capital + India’s workforce + global markets. This is not just about boosting India’s GDP; it is about positioning India as a hub for diversified supply chains at a time when the world seeks resilience beyond China.

V. The Human Bridge

Perhaps the most ambitious element is not measured in dollars but in people. The India–Japan Talent Bridge programme envisions 500,000 exchanges in five years — students, professionals, researchers. Indian engineers are already being absorbed by Fujitsu, Nidec, Musashi Seimitsu, and Dai-ichi Life Techno Cross. Universities from IITs to BITS Pilani will host career events linking Japanese firms with Indian graduates.

This exchange solves a dual challenge: Japan’s demographic decline and India’s need for global exposure. It blends Japanese language training, internships in both countries, and research partnerships. For India’s youth, it opens pathways beyond borders; for Japan’s economy, it fills gaps in innovation and workforce.

VI. Northeast Gateway: Assam’s MoU

Strategic geography is not forgotten. A MoU between the Government of Assam and ASEAN Holdings channels Japanese funds into logistics, agro-industry, and industrial infrastructure in India’s Northeast. This ties seamlessly with India’s Act East Policy and Japan’s historic interest in regional connectivity. The Northeast becomes not a periphery but a gateway — a corridor linking India to Southeast Asia with Japanese capital as the bridge.

VII. Strategic Vision: Make in India, Shape the Region

The Japan–India partnership is not confined to bilateral ties. At the Japan–India–Africa Forum and TICAD Summit in Tokyo, India emerged as an anchor in trilateral cooperation. With priorities spanning rare earths, lithium, cobalt, semiconductors, and EVs, the Indo-Japan nexus now speaks to regional security, mineral supply, and industrial corridors.

This is not just economics; it is geostrategy by other means. A resilient supply chain architecture rooted in India and Japan weakens overdependence on any single power and enhances multipolarity in Asia.

VIII. Historical Context: From Abe to Ishiba

This leap of faith builds upon decades. The Special Strategic and Global Partnership (2014) elevated ties beyond trade to encompass defence and security. Annual Summits, from Shinzo Abe’s warmth with Modi to Shigeru Ishiba’s pragmatic continuities, have created a steady arc of trust.

The high-speed rail project between Ahmedabad and Mumbai remains the flagship, but newer areas — semiconductors, clean energy, critical minerals — are the future pillars. Japan remains India’s largest ODA donor, proof that the economic relationship is as much developmental as commercial.

IX. Strategic Autonomy in Motion

In the broader canvas, Japan’s renewed commitment is a message not just to India but also to the world. As US tariffs squeeze, India signals it will not be cornered. As China looms, India demonstrates that it will partner, not align blindly. Strategic autonomy is not abstract theory — it is embodied in partnerships like this, where India retains agency, engages across poles, and multiplies options.

X. The Human Dimension

Numbers and MoUs aside, the Indo-Japan partnership is a philosophy: trust built in silence, progress made without spectacle. Unlike many partners, Japan does not trumpet conditionalities or political strings. Its presence is visible in bridges, railways, schools, IT hubs, and now in the rural fields where biogas plants turn cow dung into energy.

It is also felt in classrooms where Indian students learn Japanese, and in Tokyo offices where Indian engineers code for global products. It is a partnership that touches the everyday while shaping the strategic.

🌿 Conclusion: A Bet Beyond Numbers

From $34 billion to $68 billion — the numbers matter, but they are not the essence. What matters is the message: when the world doubts, Japan believes. When one partner raises tariffs, another opens factories. When pessimism defines headlines, confidence lays foundations.

This is not only about trade or GDP. It is about shared futures, regional stability, and the slow weaving of trust between two ancient civilizations charting a modern destiny together.

✨ IAS Monk Whisper

Steel melts into cars, waste turns into fuel, engineers become bridges — investments turn into futures. In doubling its commitment, Japan has not merely invested in India’s economy; it has invested in her possibility.

✅ Word Count: ~1220

Target IAS-26: Daily MCQs :

📌 Prelims Practice MCQs

Topic: Japan Doubles Its Bet on India

MCQ 1 – Type 1: How many of the above statements are correct?

Q. Consider the following statements regarding Japan’s recent investments in India:

1. Japan doubled its investment target in India from $34 billion to $68 billion, ahead of schedule.

2. Nippon Steel, Toyota, and Suzuki are among the major Japanese companies expanding projects in India.

3. Japanese cooperation is limited only to infrastructure and does not include rural clean energy projects.

4. The India–Japan Talent Bridge programme aims to facilitate exchanges of 5 lakh people in five years.

How many of the above statements are correct?

A) Only two

B) Only three

C) All four

D) Only one

🌀 Didn’t get it? Click here (▸) for the Correct Answer & Explanation

✅ Correct Answer: B) Only three

🧠 Explanation:

1) ✅ True – Japan doubled its target from $34B to $68B.

2) ✅ True – Nippon Steel, Toyota, Suzuki all invested heavily.

3) ❌ False – Japan is investing in biogas plants, renewable energy, and rural economy.

4) ✅ True – Talent Bridge target is 5 lakh exchanges.

MCQ 2 – Type 2: Two Statements Based

Q. Consider the following statements about India’s solar energy progress:

1) Japan’s biogas projects in India involve farmers supplying agri-waste and residues, thus creating rural income.

2) The India–Japan cooperation excludes semiconductor supply chains and focuses only on automobiles.

Which of the above statements is/are correct?

A) Only 1 is correct

B) Only 2 is correct

C) Both are correct

D) Neither is correct

🌀 Didn’t get it? Click here (▸) for the Correct Answer & Explanation

✅ Correct Answer: A) Only 1 is correct

🧠 Explanation:

1) ✅ True – Sojitz Corp. and Suzuki’s biogas projects empower farmers.

2) ❌ False – Japan is actively investing in semiconductors, e.g., Tata–Fujifilm projects.

MCQ 3 – Type 3: Which of the statements is/are correct?

Q. Which of the following are part of the India–Japan partnership announced during PM Modi’s visit?

1. Green hydrogen initiatives by Osaka Gas

2. Export of hybrid/EV vehicles made in India to Africa and Middle East

3. Assam–ASEAN Holdings MoU for Northeast industrial infrastructure

4. Suspension of bilateral talent exchange programmes due to demographic concerns

Select the correct code:

A) 1, 2 and 3 only

B) 2 and 4 only

C) 1 and 3 only

D) 1, 2, 3 and 4

🌀 Didn’t get it? Click here (▸) for the Correct Answer & Explanation

✅ Correct Answer: A) 1, 2 and 3 only

🧠 Explanation:

1) ✅ True – Osaka Gas investing in renewables & hydrogen.

2) ✅ True – EV exports part of “Make in India, Make for World.”

3) ✅ True – Assam MoU signed for Northeast growth.

4) ❌ False – Talent exchange is expanding, not suspended.

MCQ 4 – Type 4: Direct Fact

Q. Which country recently doubled its investment target in India from $34 billion to $68 billion, signaling confidence in India’s growth despite US tariffs?

A) Japan

B) South Korea

C) Germany

D) France

🌀 Didn’t get it? Click here (▸) for the Correct Answer & Explanation.

✅ Correct Answer: A) Japan

🧠 Explanation:

• Japan raised its investment target from $34B to $68B by 2026, marking accelerated trust and long-term partnership with India.