📅 May 4, 2025, Post 8: Called Back Before the Clock: Why India Recalled Its Voice at the IMF | Mains Essay Attached | Target IAS-26 MCQs Attached: A complete Package, Dear Aspirants!

Called Back Before the Clock: Why India Recalled Its Voice at the IMF

NEWSMAKER — PETAL 008

May 4, 2025

🧭 Thematic Focus:

• IMF Governance

• India’s Foreign Policy & Multilateral Diplomacy

• Transparency in Global Institutions

• Strategic Recall & Institutional Protocols

🌿 Opening Whisper:

“In the world of quiet corridors and careful signatures, even a recall can echo louder than resignation.”

🔍 Key Highlights:

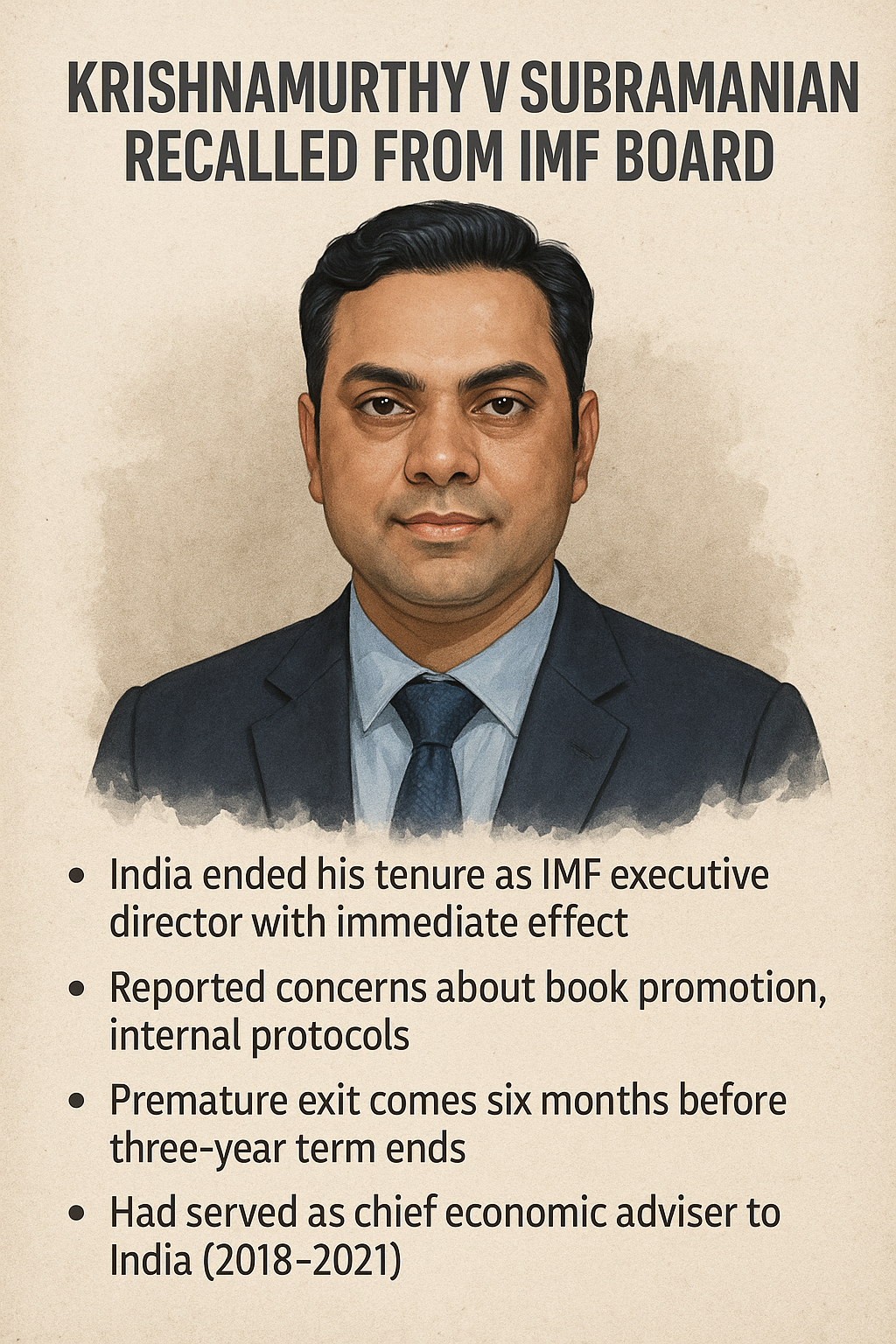

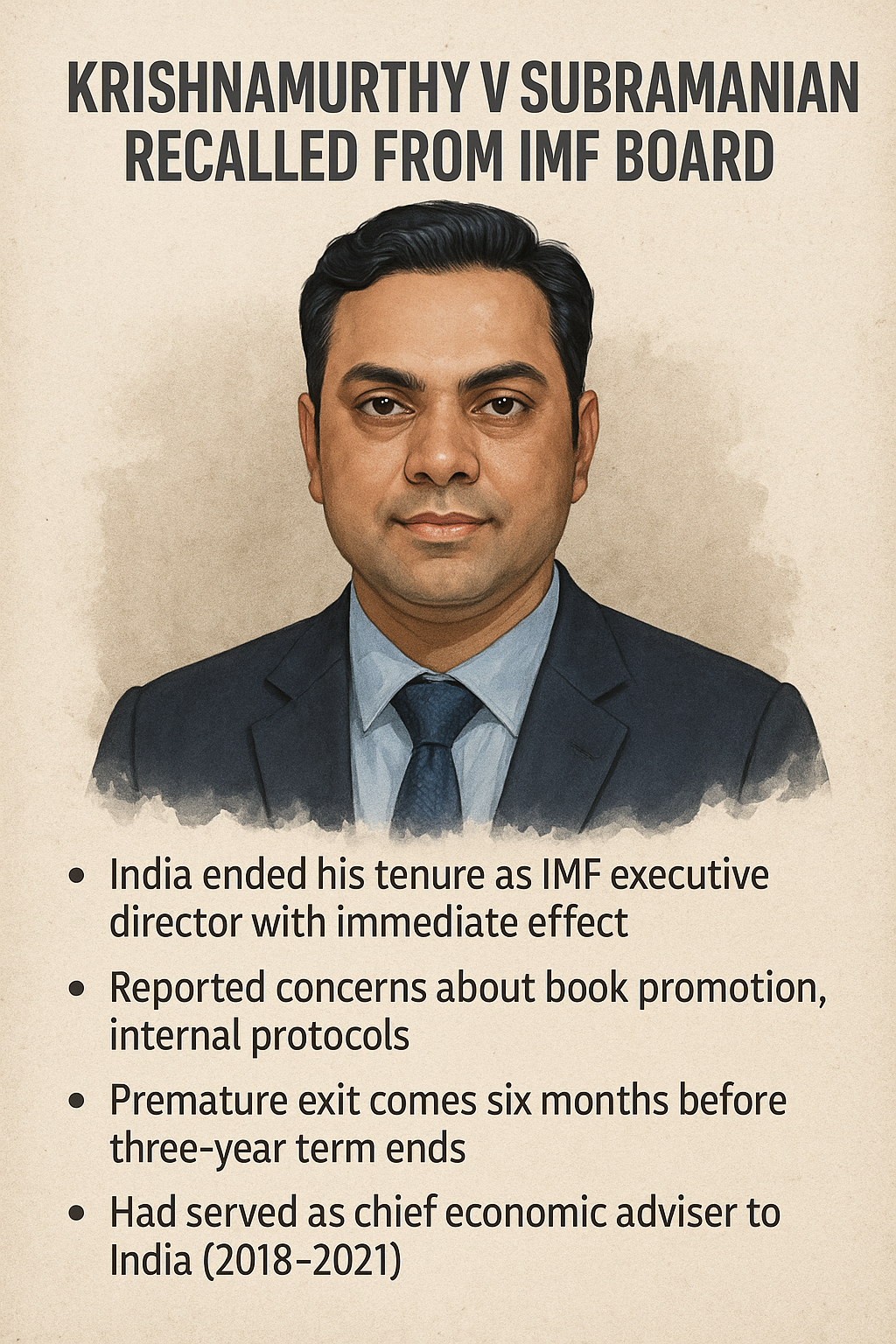

• Krishnamurthy V Subramanian, India’s Executive Director at the IMF, has been recalled 6 months ahead of his scheduled term-end in November 2025.

• The Appointments Committee of the Cabinet approved the “termination with immediate effect” on April 30, 2025. The IMF website marked India’s seat as vacant by May 3.

• Reasons not officially disclosed, but sources cite alleged “impropriety” in book promotion activities related to his work India @ 100, and violation of internal IMF protocols.

• Tensions may have escalated after Subramanian’s February 2025 critique of IMF’s weighted rating system, which he described as “skewed and misleading”.

• His sudden exit comes days before a key IMF Board meeting on May 9, where India plans to oppose financing to Pakistan, citing recent terror-linked concerns post the Pahalgam attack.

• Subramanian’s abrupt absence from an “Investing in India” event in Omaha on May 2 also added to speculation.

• The position covers India, Bangladesh, Bhutan, and Sri Lanka. The alternate director listed is Harishchandra Pahath Kumbure Gedara.

📘 Concept Explainer:

What Does an IMF Executive Director Do?

• The Executive Board of the IMF has 24 members, each representing either an individual country or a group.

• EDs are nominated by governments, and they vote on loans, discuss national policies, and steer global economic priorities.

• India, with its growing economic clout, uses this seat to shape regional financing, capacity development, and oversight.

• A vacancy, even temporary, means weakened representation in critical decisions — such as funding for neighbouring states, debt sustainability assessments, or climate finance transitions.

🎯 Why the Recall Matters:

• Reflects India’s zero-tolerance stance on institutional protocol violations.

• Shows India’s desire to ensure strategic alignment ahead of sensitive votes (e.g., Pakistan’s bailout).

• Highlights frictions between individual academic freedom and diplomatic decorum in multilateral settings.

📌 GS Paper Mapping:

• GS Paper 2 – International Institutions: IMF, Global Economic Governance

• GS Paper 2 – Polity & Governance: Appointments Committee of Cabinet

• GS Paper 3 – Economy: Multilateral lending, balance of payments

🪶 A Thought Spark — by IAS Monk:

“In diplomacy, the voice that speaks is not always as powerful as the silence that replaces it.”

High Quality Mains Essay For Practice :

Word Limit 1000-1200

IMF and the Split World: Bridging Divides or Deepening Fault Lines?

In a world fractured by wealth, walls, and war — the International Monetary Fund (IMF) stands at the crossroads of promise and paradox. Established in 1944 to promote global monetary cooperation, financial stability, and economic growth, the IMF was envisioned as a neutral arbiter — a lender of last resort for countries in crisis, and a watchdog ensuring systemic stability. But as the world’s economies have diverged into the Developed, Developing, and Least Developed Countries (LDCs), so too have the expectations — and criticisms — of the IMF.

The question before us is not just what the IMF does, but whose interests it serves, what power dynamics shape its decisions, and whether it can evolve to meet the needs of a multipolar, multivocal, and increasingly mistrustful world.

Three Worlds, One IMF

Today, the world’s economic landscape is tri-polar:

- The Developed World: Nations like the US, Germany, Japan, and UK wield outsized influence in the IMF due to their quota-based voting rights, which are tied to economic size.

- The Developing World: Countries like India, Brazil, South Africa, and Indonesia are large economies with rising global stakes, but often complain of underrepresentation and policy asymmetries in IMF structures.

- The Least Developed Countries (LDCs): Mostly from Sub-Saharan Africa and parts of Asia, these nations depend heavily on IMF loans and technical assistance, but lack voice in shaping conditionalities.

The IMF, thus, operates within a structurally unequal geometry of power — one that critics argue often reinforces old hierarchies rather than dismantling them.

The Quota Conundrum: Voting Rights vs Economic Reality

One of the deepest criticisms of the IMF stems from its quota system, which determines:

- Voting power

- Access to financing

- Representation on the Executive Board

The US alone holds around 16.5% voting power, enough to veto major policy changes (which require 85% approval). In contrast, Africa as a whole holds less than 5%. Countries like India and China, despite being among the largest economies in PPP terms, remain underweighted in influence.

While periodic quota reviews are conducted (the latest being the 16th Review), they often lag behind real-world economic shifts, keeping power concentrated in legacy economies.

Conditionalities and Credibility: A Double-Edged Sword

The IMF’s most visible function is its lending programs — often extended during Balance of Payments (BoP) crises. However, these loans come with conditionalities:

- Fiscal austerity

- Structural reforms

- Currency devaluation

- Deregulation and privatization

While meant to ensure repayment and macroeconomic discipline, these conditionalities have faced backlash, particularly in the Global South:

- Latin America (1980s–1990s) saw spiraling debt and deep recessions.

- In Africa, IMF programs were linked with welfare cuts and agricultural decline.

- In Asia, the 1997 crisis saw Indonesia and Thailand forced into painful reforms amid capital flight.

For many LDCs, the IMF became synonymous not with rescue — but with recession, dependency, and sovereignty loss.

Case in Point: IMF and Pakistan, Sri Lanka, and Ghana

Recent IMF engagements offer a window into evolving tensions:

- Pakistan: Facing pressure over alleged terror financing, India has expressed opposition to further IMF disbursements. The IMF must balance technical analysis with geopolitical signaling.

- Sri Lanka: Secured a $3 billion bailout in 2023, but only after agreeing to steep austerity, tax hikes, and reforms. The public backlash was fierce, with questions raised about the fairness of such programs.

- Ghana: Received an IMF package amid rising debt, but critics argue the IMF focused too much on fiscal math and too little on social resilience and local ownership.

Is the IMF Evolving?

To its credit, the IMF has acknowledged past mistakes and undertaken reforms:

- Flexible Credit Lines (FCLs) and Precautionary Liquidity Lines (PLLs) offer crisis buffers without harsh conditionalities.

- Debt Sustainability Frameworks now incorporate climate vulnerability and SDG-linked investments.

- The Resilience and Sustainability Trust (RST) supports long-term challenges like climate change and pandemics.

But concerns remain about internal opacity, the hegemony of Western narratives, and lack of Southern leadership in key decisions.

India and the IMF: Between Aspiration and Assertion

India’s relationship with the IMF has matured:

- Once a borrower (notably during the 1991 crisis), India is now a donor and policy shaper.

- Indian officials — like Krishnamurthy V Subramanian, Raghuram Rajan, and Surjit Bhalla — have held key roles at the IMF and World Bank.

- India advocates for greater say for developing economies and for a development-centric approach rather than austerity-first conditionalities.

The recent recall of Subramanian from the IMF Board, reportedly due to internal protocol violations, also reflects the delicate balance between domestic politics, multilateral conduct, and institutional discipline.

Philosophical Reflection: Can a Global Institution Be Truly Fair?

In a world of uneven capabilities, absolute fairness may be elusive, but procedural fairness must be non-negotiable. Philosopher John Rawls argued for justice as fairness — not necessarily equal outcomes, but justified differences with equal opportunity.

The IMF must move from being a financial technocracy to a moral multilateralism — one that:

- Hears small states

- Shares burdens equitably

- Respects local voices

- Rewards long-term resilience, not short-term compliance

Otherwise, it risks losing legitimacy — becoming not an international monetary fund, but an institutional memory of inequality.

Conclusion: Reform or Redundancy

In today’s fractured world — of currency wars, debt distress, and climate catastrophe — the IMF can either be a force for convergence or become a relic of economic colonialism.

To stay relevant, it must:

- Reform quota systems urgently

- Diversify leadership across continents

- Design inclusive conditionalities

- Embrace digital, green, and social economy frameworks

- Anchor trust with transparency

The world doesn’t need more institutions. It needs the ones we have to work better, fairer, and faster — not just for the wealthy few, but for the waiting many.

Closing Quote:

“An institution is not judged by the power it holds, but by the power it shares.” — IAS Monk

Target IAS-26: Daily MCQs :

📌 Prelims Practice MCQs

Topic:

📘 MCQ 1: IMF Governance and Voting Structure

Which of the following statements regarding IMF governance are correct?

•1) Voting power at the IMF is based on the size of a country’s GDP at market exchange rates.

•2) The US has veto power over major IMF policy decisions due to its quota share.

•3) All IMF member countries have equal voting rights, ensuring full equity in decisions.

•4) India and China are underrepresented in voting share compared to their economic size.

A) Only two

B) Only three

C) All four

D) Only one

🌀 Didn’t get it? Click here (▸) for the Correct Answer & Explanation

✅ Correct Answer: B) Only three

🧠 Explanation:

•1) ✅ Correct. IMF voting power is determined by economic size, primarily measured in market exchange rates, not PPP.

•2) ✅ Correct. The US holds over 16% voting power, giving it de facto veto authority (major changes require 85% votes).

•3) ❌ Incorrect. IMF uses weighted voting, not equal voting — hence structural inequality exists.

•4) ✅ Correct. India and China have long argued for greater representation, especially given their global economic rank.

Hence, statements 1, 2, and 4 are correct.

📘 MCQ 2: Lending Practices and Criticisms of the IMF

Which of the following are common criticisms of IMF lending practices in developing and least developed countries (LDCs)?

•1) IMF loan conditionalities often result in public spending cuts.

•2) Structural adjustment programmes have been linked to deep recessions and social unrest.

•3) IMF imposes uniform fiscal reforms without accounting for cultural or political contexts.

•4) All IMF lending is provided without any preconditions.

A) Only two

B) Only three

C) All four

D) Only one

🌀 Didn’t get it? Click here (▸) for the Correct Answer & Explanation

✅ Correct Answer: B) Only three

🧠 Explanation:

•1) ✅ Correct. Austerity measures, especially cutting subsidies and welfare spending, are common IMF conditionalities.

•2) ✅ Correct. In regions like Africa and Latin America, IMF-linked reforms have been followed by economic hardship.

•3) ✅ Correct. A frequent criticism is the “one-size-fits-all” model of reforms, regardless of local realities.

•4) ❌ Incorrect. Many IMF loans are conditional; only a few facilities (like FCL) are low-conditionality.

Hence, statements 1, 2, and 3 are correct.

MCQ 3: IMF Executive Board and India’s Representation

Which of the following statements about India’s representation on the IMF Executive Board are correct?

India shares its Executive Director seat with Bangladesh, Bhutan, and Sri Lanka.

The Executive Director is elected by India’s Parliament.

Krishnamurthy V Subramanian was appointed as IMF ED in 2022 for a 3-year term.

IMF EDs are responsible for day-to-day operations and major lending decisions.

A) Only two

B) Only three

C) All four

D) Only one

🌀 Didn’t get it? Click here (▸) for the Correct Answer & Explanation

✅ Correct Answer: B) Only three

🧠 Explanation:

•1) ✅ Correct. India shares its IMF Executive Director seat with Bangladesh, Bhutan, and Sri Lanka.

•2) ❌ Incorrect. The ED is nominated by the government, not elected by Parliament.

•3) ✅ Correct. Subramanian’s term began in November 2022 for 3 years.

•4) ✅ Correct. IMF EDs handle policy reviews, financing approvals, and surveillance.

Hence, statements 1, 3, and 4 are correct.

📘 MCQ 4: Quota System and Global Representation in IMF

Which of the following reflect accurate observations about the IMF quota system?

1. Quotas determine voting power, financing access, and Board representation.

2. The US holds a veto due to its high quota share.

3. The least developed countries have the largest quotas to ensure equity.

4. Quota reforms are conducted every five years through the IMF’s Board of Governors.

A) Only two

B) Only three

C) All four

D) Only one

🌀 Didn’t get it? Click here (▸) for the Correct Answer & Explanation

✅ Correct Answer: A) Only two

🧠 Explanation:

•1) ✅ Correct. Quotas determine voting rights, access to resources, and Board presence.

•2) ✅ Correct. With 16.5% voting power, the US effectively holds a veto on major decisions (85% threshold).

•3) ❌ Incorrect. LDCs have the lowest quotas, despite high vulnerability.

•4) ❌ Incorrect. Quota reviews are proposed every 5 years, but not consistently implemented.

Hence, only statements 1 and 2 are correct.

📘 MCQ 3: Conditionality and Reform in IMF Lending

Which of the following are correct regarding IMF’s lending policies and recent reforms?

Flexible Credit Lines and Resilience Trusts are recent tools to support countries without harsh austerity.

Structural adjustment programs are no longer in use after 2008.

Conditionalities often include fiscal austerity, deregulation, and subsidy rationalisation.

IMF lending decisions are influenced by geopolitical considerations.

A) Only two

B) Only three

C) All four

D) Only one

🌀 Didn’t get it? Click here (▸) for the Correct Answer & Explanation

✅ Correct Answer: B) Only three

🧠 Explanation:

•1) ✅ Correct. Flexible Credit Lines and the Resilience and Sustainability Trust are post-2008 tools.

•2) ❌ Incorrect. Structural adjustments are still used, though rebranded under various frameworks.

•3) ✅ Correct. IMF often demands austerity, deregulation, and fiscal consolidation.

•4) ✅ Correct. Geopolitical factors, like Pakistan’s terror links, influence IMF deliberations.

Hence, statements 1, 3, and 4 are correct.