📅 May 4, 2025, Post 3: 💼 The Sage’s Silence: Buffett’s Last Bow and the Business Legacy Beyond | Mains Essay Attached |Target IAS-26 MCQs Attached: A complete Package, Dear Aspirants!

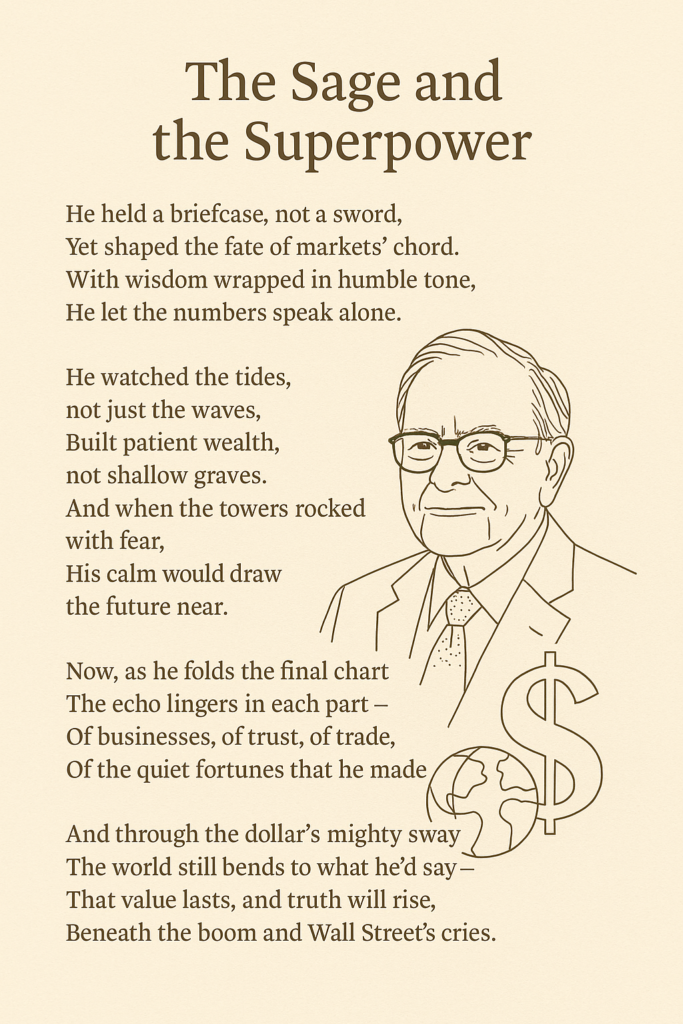

💼 The Sage’s Silence: Buffett’s Last Bow and the Business Legacy Beyond

NEWSMAKER — PETAL 003

🗓️ May 4, 2025

Theme: Leadership Succession | Global Markets | Economic Wisdom

🌸 Intro Whisper

In the quiet of a crowded arena, a 94-year-old voice that once steered the markets like a moral compass whispered a farewell—and the world leaned in to listen.

🔍 Key Highlights

- Buffett to Retire:

Warren Buffett stunned thousands at the Berkshire Hathaway annual shareholders meeting by announcing he would retire at the end of 2025, recommending Greg Abel as his successor. It marks the end of a 60-year leadership era. - The Greg Abel Transition:

Abel, currently overseeing all non-insurance businesses at Berkshire, is seen as a more hands-on manager. Buffett believes he will respect the autonomy of Berkshire’s many subsidiaries while bringing operational vigor. - Warning Against Tariff Wars:

Buffett sharply criticized Donald Trump’s tariff regime, calling it a “big mistake” and warning that using trade as a weapon could destabilize global relations. He emphasized the idea that “trade should not be a war.” - Cash Reserves & Market Caution:

Berkshire is currently sitting on $347.7 billion in cash, waiting for the right moment to invest. Buffett dismissed current market dips as minor, recalling the Great Depression’s real crashes as benchmarks. - Faith in America’s Long Game:

Despite current turbulence, Buffett remains bullish on America’s future. “I’d negotiate in the womb just to be born in the U.S.,” he joked, reaffirming long-term optimism in the U.S. economy. - Succession Anxiety & Confidence:

While shareholders like Linda Smith and Steven Check will miss Buffett’s voice, they express faith in the Berkshire model and in Abel’s leadership, rooted in business autonomy and value investing. - A Global Symbol of Stability:

Attendees came from around the world, including China, to pay tribute to Buffett’s legacy. Even Hillary Clinton made an appearance, highlighting his lasting influence across political and financial domains.

🧭 GS Paper Mapping

- GS Paper 3 – Indian Economy (Investment Strategy, Financial Markets)

- GS Paper 2 – International Relations (US Trade Policies, Global Stability)

- Essay/Philosophy – Leadership, Legacy, and the Ethics of Capital

💭 A Thought Spark — by IAS Monk

“When the Sage of Omaha sets down his briefcase, he leaves behind not silence, but a trail of timeless truths—about patience, trust, and the quiet art of growing wisely.”

High Quality Mains Essay For Practice :

Word Limit 1000-1200

Warren Buffett and the American Engine: How One Man Shaped a Nation, and How That Nation Shapes the World

In the long arc of history, certain individuals transcend their fields to become symbols of an era. Warren Buffett, often called the “Oracle of Omaha,” is not just one of the most successful investors in history—he is a living embodiment of America’s economic philosophy: value-based, long-term, and deeply democratic. His impact on the U.S. economy is profound, not merely in terms of numbers, but in terms of temperament, ethics, and national confidence. As he prepares to retire after more than 60 years at the helm of Berkshire Hathaway, it is an opportune moment to examine how Buffett has influenced the American economy—and how, in turn, the American economy continues to influence the world.

I. Warren Buffett: The Man Who Made Patience Profitable

Buffett’s economic influence stems not from innovation or disruption, but from discipline. His philosophy—“Buy wonderful businesses at fair prices and hold them forever”—stood in stark contrast to the speculative volatility of modern finance.

- Berkshire Hathaway under his leadership grew into a $700+ billion conglomerate owning or investing in iconic American companies like Coca-Cola, Apple, Geico, and BNSF Railway.

- Through annual shareholder letters and public speeches, Buffett promoted the virtues of long-term investing, corporate accountability, and financial prudence.

- He inspired generational investors and shaped public opinion on everything from taxation to philanthropy.

His influence, however, was not limited to markets. Buffett’s steady voice during crises—be it the dot-com bust, 2008 financial collapse, or COVID-induced turmoil—offered economic reassurance to the average American and policymakers alike.

II. Buffett’s Ripple Effect on the American Economic Ethos

Buffett’s economic impact is best understood through three key lenses:

A. Investor Behavior and Market Stability

- His emphasis on value over speculation reshaped retail investment culture. Thousands of Americans, inspired by his teachings, moved toward low-risk, equity-based portfolios that boosted long-term capital formation.

- During market panics, Buffett’s actions—such as investing in Goldman Sachs during the 2008 crisis—restored public confidence and prevented deeper contagion.

B. Corporate Governance and Ethical Capitalism

- Buffett popularized the concept of “moat” investing—favoring companies with enduring competitive advantages.

- He demanded transparency, fiscal discipline, and management integrity from firms Berkshire invested in, indirectly raising corporate standards.

- His low personal salary, frugality, and refusal to exploit loopholes made him a moral compass in a field often clouded by greed.

C. Wealth, Taxation, and Philanthropy

- A strong proponent of taxing the wealthy more fairly, Buffett famously stated that he paid a lower tax rate than his secretary—prompting debates on capital gains taxation.

- Through the Giving Pledge, he and Bill Gates initiated a philanthropy movement that redefined how wealth should be returned to society.

In all these ways, Warren Buffett helped shape America’s modern economic culture—one rooted in realism, restraint, and responsibility.

III. The American Economy: A Global Weather Vane

While Buffett symbolizes economic wisdom, the American economy itself functions as a global axis of growth and stability. The dollar is the world’s reserve currency; U.S. interest rates determine global capital flows; American consumption drives global supply chains.

A. Financial Gravity: The Dollar and Wall Street

- Over 60% of global foreign exchange reserves are held in U.S. dollars.

- American financial institutions influence global credit markets, portfolio investments, and sovereign bond yields.

- The Federal Reserve’s monetary policy often becomes de facto policy for emerging economies, which must adjust domestic interest rates to avoid capital flight.

B. Trade Networks and Technological Hegemony

- The U.S. is not just a consumer giant—it remains the center of global innovation.

- American firms dominate the digital economy: Google, Apple, Amazon, and Microsoft are not just companies; they are global platforms.

- U.S. trade policies, especially tariffs or sanctions, can reshape entire industries—as seen in the semiconductor wars with China.

C. Soft Power and Rule-Setting

- Beyond economics, the U.S. exports institutions, norms, and frameworks: property rights, accounting standards, antitrust laws, and data privacy models.

- Institutions like the IMF, World Bank, and WTO operate on rules largely written or backed by the United States.

In short, when America sneezes, the world doesn’t just catch a cold—it resets its thermostat.

IV. From Omaha to the World: Buffett’s Legacy in a Global Context

The synergy between Buffett’s approach and America’s economic machinery is not accidental—it is symbiotic.

- His investments in companies like Apple or Coca-Cola boosted not only U.S. firms but also global value chains.

- His criticism of Trump-era tariffs had global diplomatic echoes, reminding leaders that trade cooperation, not confrontation, sustains peace.

- His presence at international forums and popularity in countries like China, India, and Japan reflect how finance—when fused with humility—crosses borders.

Buffett represents the best version of American capitalism—patient, ethical, and productive. At a time when capitalism is under scrutiny for exacerbating inequality and climate degradation, Buffett’s example offers a middle path: capitalism with conscience.

V. Challenges Ahead: Who Will Carry the Flame?

With Buffett’s retirement and generational transitions underway, several concerns loom:

- Will shareholder-first capitalism endure?

The rise of algorithmic trading, ESG investing, and activist hedge funds may dilute the long-term vision Buffett espoused. - Can the American economy stay stable amid multipolarity?

Rising economic nationalism, de-dollarization efforts, and supply chain decoupling pose risks to U.S. hegemony. - Will values keep pace with value?

As wealth concentrates in fewer hands, will future billionaires carry forward Buffett’s ethics of giving, prudence, and mentorship?

These questions point to a turning point, both for the U.S. economy and its role in the world. It is no longer enough to be rich; one must be relevant and responsible.

Conclusion: The Quiet Power of Rational Optimism

Warren Buffett once said, “The best investment you can make is in yourself.” But what he really taught the world was that investing in principles, patience, and people yields the greatest returns—economic and otherwise.

As he steps down, Buffett’s shadow does not darken—it illuminates. His voice may grow silent, but his influence will echo through generations of entrepreneurs, policymakers, and everyday savers.

And as long as the American economy honors the ethos Buffett championed—long-term thinking, ethical wealth, shared prosperity—it will continue to influence the world not just through its might, but through its mindful momentum.

Would you like this essay in a PDF format or with a poetic Tablet visual summary?

You said:

Give some end Quote to this Essay and then Poetic Tablet

ChatGPT said:

✅ Closing Quote for the Essay

“You only find out who is swimming naked when the tide goes out.”

— Warren Buffett

This quote encapsulates Buffett’s lifelong belief in transparency, patience, and the truth of fundamentals—making it a fitting end to an essay about his legacy and America’s global economic role.

Target IAS-26: Daily MCQs :May 4, 2025

📌 Prelims Practice MCQs

Topic: Global Financial Reforms and Sustainable Development Goals

MCQ 1 (Type-1: “How many statements are correct?”)

Which of the following statements regarding Warren Buffett’s recent announcement and economic views are correct?

1. Warren Buffett announced his retirement and recommended Greg Abel as his successor.

2. Buffett supports using trade as a weapon to secure favorable economic deals.

3. Buffett warned that global instability could result from widespread tariffs.

4. Berkshire Hathaway currently holds over $340 billion in cash reserves.

A) Only two

B) Only three

C) All four

D) Only one

🌀 Didn’t get it? Click here (▸) for the Correct Answer & Explanation

✅ Correct Answer: B) Only three

🧠 Explanation:

1. ✅ Correct – Buffett announced retirement and endorsed Greg Abel.

2. ❌ Incorrect – He explicitly said “trade should not be a weapon.”

3. ✅ Correct – He warned about instability due to Trump’s tariff policy.

4. ✅ Correct – Berkshire has $347.7 billion in cash, as stated during the meeting.

MCQ 2 (Type-2: Two-Statement Format)

Consider the following statements:

1. Buffett compared the Great Depression to modern market drops to highlight the minor nature of current turmoil.

2. Greg Abel currently oversees Berkshire Hathaway’s insurance business units and was previously a political advisor.

A) Only 1 is correct

B) Only 2 is correct

C) Both are correct

D) Neither is correct

🌀 Didn’t get it? Click here (▸) for the Correct Answer & Explanation

✅ Correct Answer: A) Only 1 is correct

🧠 Explanation:

1. ✅ True – He cited the Dow falling from 240 to 41 in the Great Depression to show perspective.

2. ❌ False – Greg Abel manages non-insurance businesses, not insurance, and was not a political advisor.

MCQ 3 (Type-3: Multiple Correct Options)

Which of the following actions or views are associated with Warren Buffett?

1. Advocated for higher taxation on the wealthy.

2. Created the Giving Pledge to encourage billionaire philanthropy.

3. Regularly engages in short-term, high-frequency trading.

4. Emphasized long-term value investing.

A) 1, 2 and 4 only

B) 2 and 3 only

C) All four

D) 1 and 4 only

🌀 Didn’t get it? Click here (▸) for the Correct Answer & Explanation

✅ Correct Answer: A) 1, 2 and 4 only

🧠 Explanation:

✅ Buffett has often criticized the low tax rates on the ultra-rich.

✅ He co-founded the Giving Pledge with Bill Gates.

❌ False – He is not involved in short-term trading; he advocates long-term value investment.

✅ Long-term value investing is his signature strategy.

MCQ 4 (Type-4: Factual Recall)

Warren Buffett has led Berkshire Hathaway for approximately how many years as of 2025?

A) 40 years

B) 50 years

C) 60 years

D) 70 years

🌀 Didn’t get it? Click here (▸) for the Correct Answer & Explanation.

✅ Correct Answer: A) 1, 2 and 4 only

🧠 Explanation:

• Buffett took control of Berkshire Hathaway in 1965 and has led it continuously, making it 60 years as of 2025.