📅 May 12, 2025, Post 5: 🛢️ India’s Strategic Grip: Pre-emption Rights on Oil and Gas |High Quality Mains Essay | Prelims MCQs

🛢️ India’s Strategic Grip: Pre-emption Rights on Oil and Gas

NATIONAL HERO — PETAL 005

🗓️ May 12, 2025

📚 GS Paper 3 – Energy Security / Economy / Disaster Management

⚖️ Intro Whisper

When the earth cracks open or borders burn,

Who holds the right to the fire beneath?

🔹 Key Highlights

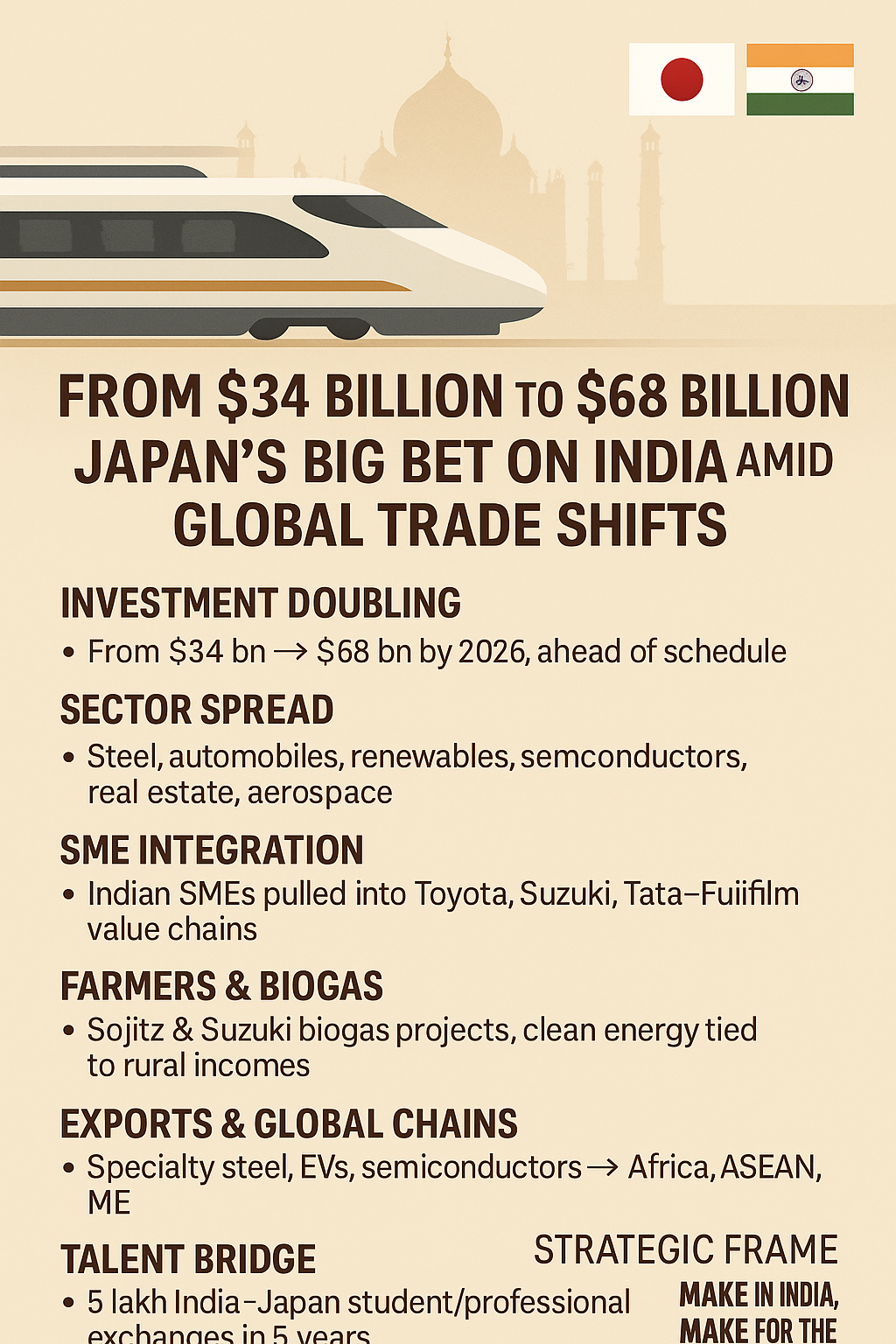

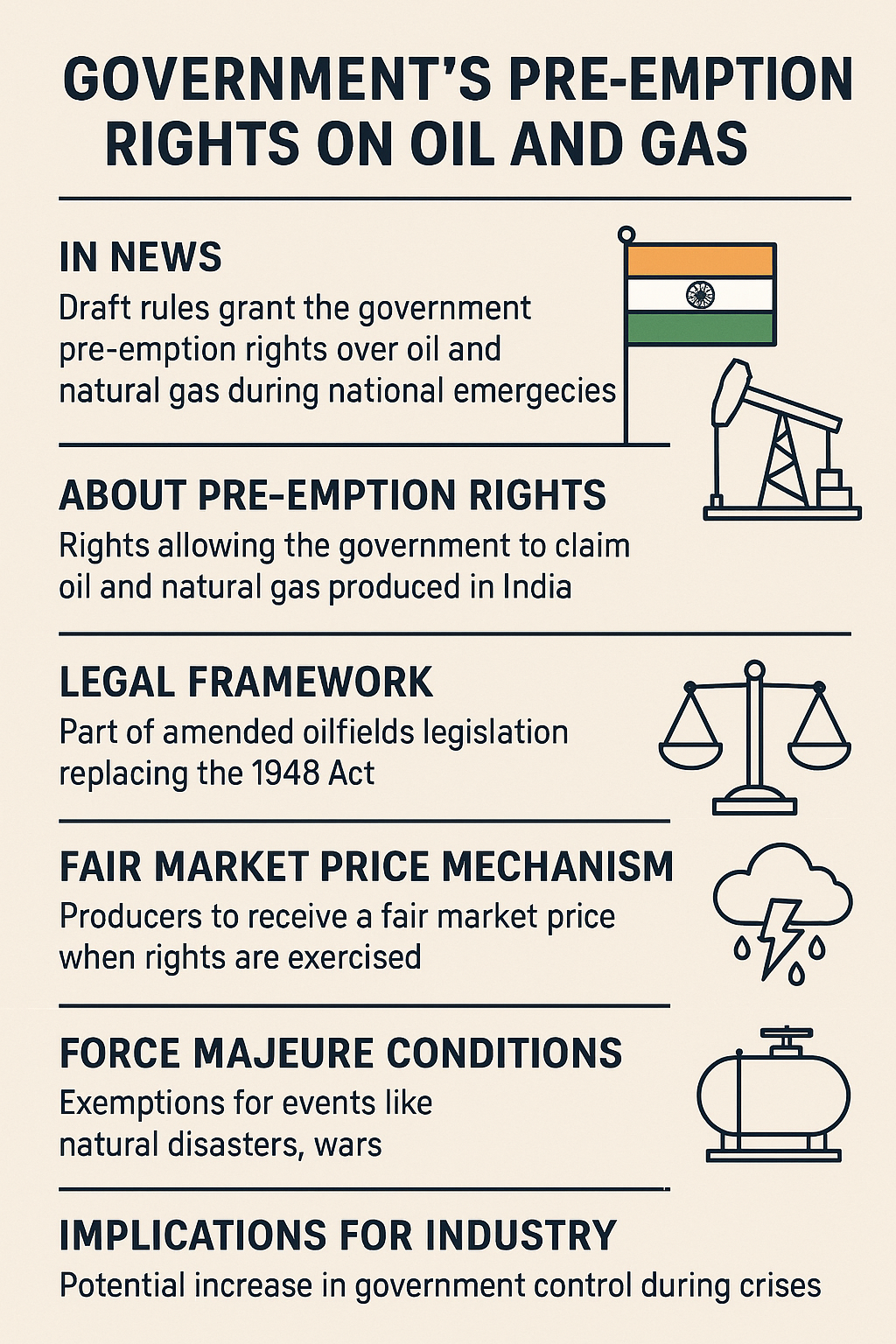

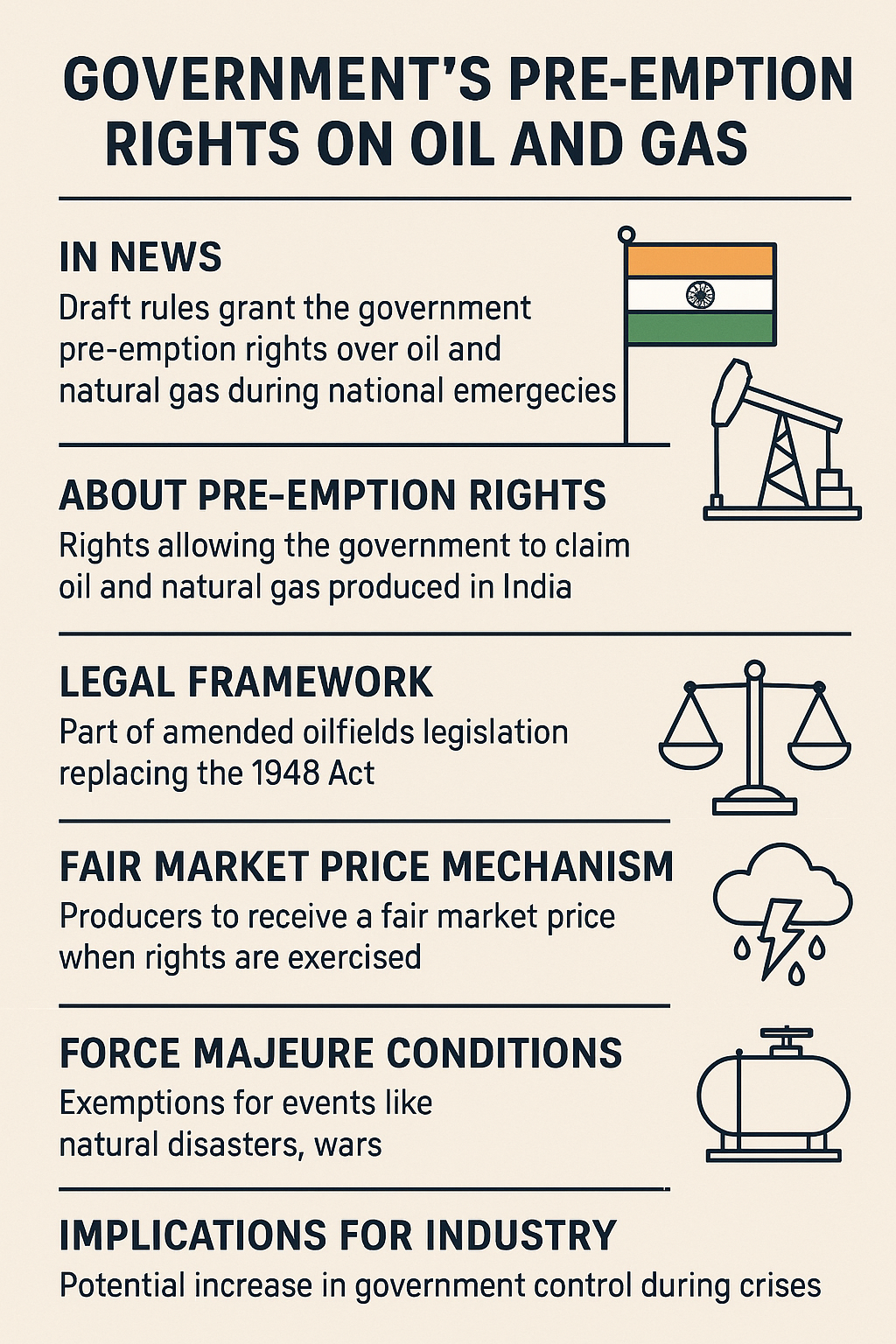

- New Draft Rules Introduced: Under the amended Oilfields (Regulation and Development) Act, the government now has pre-emption rights on oil and gas during national emergencies.

- What are Pre-emption Rights?: Legal provision allowing government priority claim over domestic oil/gas production before it is offered elsewhere.

- Emergency Clause: While the term ‘national emergency’ isn’t precisely defined, the government reserves full authority to decide — covering events like war, pandemics, or disasters.

- Fair Market Compensation: Producers will be paid at prevailing market rates, ensuring fair compensation even during pre-emptive takeover.

- Force Majeure Protection: Operators are shielded from liability in case of natural disasters, wars, or uncontrollable events.

- Impacts on Industry: Oil/gas firms must align with new compliance regimes, reshaping contracts and long-term planning.

- Wider Objective: Reflects India’s strategic energy vision — securing national needs during crises, and reinforcing economic stability and public welfare.

📘 Concept Explainer: Why Pre-emption Rights Matter

Pre-emption rights are not new in sovereign governance — especially in strategic sectors. Globally, countries often invoke such clauses during:

- Wars

- Global supply disruptions

- Natural calamities

- Pandemics or embargoes

India’s inclusion of this clause under an updated law indicates a dual intent:

- Modernize outdated petroleum laws (dating back to 1948).

- Secure domestic energy resources in times of crisis.

In practice:

- Oil or gas produced within India can be acquired by the government before producers sell it elsewhere.

- This can be triggered via a formal declaration of emergency by the Union Government.

- However, producers will receive fair market value, avoiding arbitrary confiscation.

This move reflects lessons from:

- COVID-19 global energy supply shocks

- Ukraine conflict, which reshaped gas diplomacy

- Domestic surge in energy needs during disaster response

🛑 Force Majeure Conditions Explained

Force majeure = “superior force”

Operators are exempt from contractual obligations if:

- A natural disaster (floods, earthquakes, etc.) occurs

- Armed conflict or war breaks out

- Events occur beyond human control affecting extraction/distribution

This prevents punitive enforcement of contracts during humanitarian crises or natural calamities.

🛢️ Implications for Oil & Gas Industry

- Private Sector Readiness: Firms must account for pre-emption scenarios in risk assessment and supply planning.

- Investment Outlook: Foreign investors may demand clarity on emergency definitions and compensation safeguards.

- Operational Shifts: Need for crisis-compliance frameworks built into energy contracts.

This may also enhance trust if managed transparently — ensuring resource nationalism doesn’t translate into arbitrary interventions.

🛡️ Public Welfare Consideration

The law pivots on a citizen-first philosophy — in times of crisis:

- Hospitals must not run out of gas

- Relief shelters must remain lit

- Industrial supply can be redirected to essentials

- Strategic fuel reserves can be tapped swiftly

This shows a governance model centered around resilience, not just revenue.

🗺️ GS Paper Mapping

| Paper | Theme | Relevance |

|---|---|---|

| GS-3 | Economy / Resources | Oil & Gas Regulation, Energy Policy |

| GS-3 | Disaster Management | Emergency Resource Allocation |

| GS-2 | Governance | Legal Frameworks for Strategic Sectors |

✨ A Thought Spark — by IAS Monk

When scarcity knocks, and fear flows through pipes,

A sovereign steps in — not with force, but with foresight.

To light a million homes, one flame must be held back.

High Quality Mains Essay For Practice :

Word Limit 1000-1200

Guardians of the Flame: India’s Pre-emption Rights on Oil and Gas in a World of Uncertainty

🔥 Introduction: The Sovereign Claim in a Crisis Age

In a world increasingly vulnerable to climate shocks, wars, and economic instability, energy security has become the new sovereignty. India’s recent move to introduce pre-emption rights on domestic oil and natural gas production represents not just a legal amendment — but a strategic statement. Through the lens of crisis preparedness, national security, and economic governance, the pre-emption framework transforms energy from a mere commodity into a state-controlled instrument of survival.

This essay explores the rationale, structure, and implications of India’s new energy regime — from legal innovation to industrial consequences, from public welfare to private concern.

⚖️ Understanding Pre-emption Rights: The Logic of Sovereign First

Pre-emption rights refer to a government’s legal entitlement to access or purchase essential resources before private entities or foreign buyers, especially during emergencies. In this context, the Indian government now reserves the right to claim a portion — or all — of the oil and gas produced within the country in times of national need.

Historically, nations have exercised such rights during:

- Wartime fuel shortages

- Natural calamities disrupting energy infrastructure

- Health emergencies like pandemics

- Sudden geopolitical supply disruptions (e.g., Ukraine war, OPEC shocks)

India’s legal codification under the Oilfields (Regulation and Development) Amendment Bill modernizes a colonial-era framework and equips the country with tools for real-time resource protection.

🏛️ The New Legal Framework: From 1948 to 2025

The previous Oilfields Act, dating back to 1948, was ill-equipped to handle the complexities of modern energy economics, contractual partnerships, and emergency interventions. The new draft rules now:

- Grant pre-emption authority to the Union Government during emergencies

- Provide a “fair market price” to producers when such rights are exercised

- Define force majeure exemptions for operators during uncontrollable disruptions

- Empower the government to interpret and declare what constitutes an emergency

This balance — between strategic sovereignty and economic fairness — is the cornerstone of the revised legislation.

🌪️ Emergencies in the Grey: Defining the Undefined

One of the most delicate aspects of the law is its flexible definition of national emergency. The draft rules leave it undefined — deliberately so — allowing the executive discretion to include:

- War and military conflicts

- Major pandemics or health catastrophes

- Severe natural disasters (cyclones, earthquakes, tsunamis)

- Global energy market collapse or international embargoes

While this ensures operational flexibility, it also raises concerns about transparency, overreach, and potential for political misuse unless clearly regulated.

💰 The Fair Market Compensation Clause: Balancing Public and Private

To maintain investor confidence, the government commits to paying a fair market price to oil and gas companies in times of pre-emption. This ensures:

- No arbitrary confiscation or nationalization

- Market-linked pricing aligned with global benchmarks

- Legal protection for foreign and domestic investors

This mechanism reflects India’s dual commitment: protect the nation during crises, but not at the cost of investor integrity.

⛽ Force Majeure: Shielding the Operators

The law introduces force majeure clauses, releasing energy operators from obligations when crises prevent them from fulfilling their contracts. These include:

- Earthquakes, floods, and tsunamis

- Armed conflict or insurgency

- Sudden supply chain collapse

- Technological breakdowns

This protects businesses from contractual penalties, maintains sectoral stability, and recognizes that crisis resilience must include corporate sustainability.

🧭 Strategic Implications: What It Means for India

India is the third-largest energy consumer in the world and imports nearly 85% of its crude oil. In such a landscape, domestic production is strategically priceless.

The new pre-emption rules enable the following:

- Emergency reserves access: Without needing new infrastructure

- Faster disaster response: Fuel can be diverted to critical sectors

- Reduced dependency during conflicts: Avoid being hostage to global price spikes

- State-backed prioritization: Transport, healthcare, and food supply chains come first

In sum, it prepares India for a future where energy is not just priced — it is weaponized.

💼 Industry Concerns: Uncertainty in Opportunity

Despite long-term benefits, oil and gas companies may express reservations:

- Lack of clarity on emergency triggers

- Contractual unpredictability

- Fear of increased government interference

- Challenges in integrating new clauses into existing production-sharing contracts

For foreign investors especially, India must clearly communicate rule-of-law protections to avoid creating a climate of suspicion.

🧬 Energy Justice: A Citizen-Centric Approach

At its core, the pre-emption clause is about energy justice — ensuring that:

- Villages get LPG during floods

- Hospitals stay powered during blackouts

- Army operations don’t run dry in wartime

- Price shocks don’t cripple food transport

This reflects a moral shift in governance — from market-first to citizen-first, while still upholding competitive capitalism.

🌐 Global Parallels and Lessons

Other countries have similar systems:

- United States: The President can invoke the Defense Production Act

- Germany and France: Emergency control over fuel reserves

- China: Strategic petroleum reserves controlled by the state

- Japan and South Korea: Formalized rationing systems for fuel

India’s move aligns with this trend of resource nationalism under legal cover, particularly in an era of global volatility.

🔚 Conclusion: The Flame Must Burn for All

India’s pre-emption policy is not a relic of protectionism — it is a framework for preparedness. In an unpredictable world, the ability to prioritize public welfare over profit, stability over supply chains, and human dignity over corporate earnings is not authoritarianism — it is governance with courage.

The flame beneath the earth may belong to private hands in peace,

But in times of chaos, it must light the path for the nation.

🧠 Closing Quote

“Oil may fuel economies, but in emergencies, it must fuel humanity.” — IAS Monk

Target IAS-26: Daily MCQs :

📌 Prelims Practice MCQs

Topic:

MCQ 1: Type – “How many of the above statements are correct?”

Consider the following statements about India’s draft pre-emption rules on oil and gas:

1.Pre-emption rights allow the government to claim oil and gas produced in India during national emergencies.

2.The government must pay a fixed predetermined price when exercising these rights.

3.Force majeure conditions exempt operators from liabilities in case of natural disasters.

4.The definition of national emergency is clearly specified in the draft rules.

How many of the above statements are correct?

A) Only two

B) Only three

C) All four

D) Only one

🌀 Didn’t get it? Click here (▸) for the Correct Answer & Explanation

✅ Correct Answer: A) Only two

🧠 Explanation:

•1) Correct – Government can claim oil and gas in emergencies.

•2) Incorrect – Payment is made at fair market price, not fixed.

•3) Correct – Force majeure covers natural disasters and wars.

•4) Incorrect – Emergency definition is not clearly specified in the draft.

MCQ 2: Type – Two Statements

Consider the following two statements:

1.The pre-emption clause in oil and gas applies only to private companies, not public sector units.

2.The Oilfields (Regulation and Development) Amendment Bill replaces the outdated law from 1948.

Which of the above statements is/are correct?

A) Only 1 is correct

B) Only 2 is correct

C) Both are correct

D) Neither is correct

🌀 Didn’t get it? Click here (▸) for the Correct Answer & Explanation

✅ Correct Answer: B) Only 2 is correct

🧠 Explanation:

•1) Incorrect – The clause applies uniformly, regardless of ownership.

•2) Correct – The amendment replaces the 1948 oilfields regulation.

MCQ 3: Type – “Which of the above statements is/are correct?”

Consider the following statements:

1.Fair market value is paid to producers when pre-emption rights are exercised.

2.Pre-emption rights apply even outside declared emergencies.

3.Force majeure includes events such as war and earthquakes.

Which of the above statements is/are correct?

A) 1 and 2 only

B) 1 and 3 only

C) 2 and 3 only

D) All of the above

🌀 Didn’t get it? Click here (▸) for the Correct Answer & Explanation

✅ Correct Answer: B) 1 and 3 only

🧠 Explanation:

•1) Correct – Payment is based on prevailing market conditions.

•2) Incorrect – These rights apply only during declared emergencies.

•3) Correct – Force majeure covers wars, disasters, and other uncontrollable events.

MCQ 4: Type – Direct Fact-Based

Which of the following best defines ‘pre-emption rights’ in the context of the oil and gas industry?

A) The government’s right to set oil prices in the domestic market

B) The authority to cancel private contracts in times of peace

C) The right to claim produced oil and gas before it is sold elsewhere during emergencies

D) A taxation benefit provided to oil-producing states during droughts

🌀 Didn’t get it? Click here (▸) for the Correct Answer & Explanation.

✅ Correct Answer: C) The right to claim produced oil and gas before it is sold elsewhere during emergencies

🧠 Explanation:

•Pre-emption rights legally enable the government to prioritize national access to energy resources in emergencies, before they enter commercial markets.